The market is currently trading at record highs, boosted by the prospect of business-friendly tax reforms. And according to Bank of America, this bull market still has plenty of ‘gas in the tank’. Technical analysts from BoA say the S&P 500 could hit 3,000 by the end of 2018. They compare the chart for 2018 to the one from 2014, when the market gained 11%.

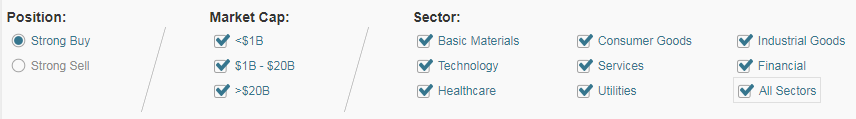

In light of this bullish analysis, we turned to TipRanks’ Top Stocks tool to see which stocks are primed for a strong performance over the next 12 months. Top recommended stocks are based on a TipRanks developed formula, factoring in ratings made by the best performing analysts. Using this nifty tool, we selected the following criteria:

Crucially we sorted the stocks by upside potential to quickly pinpoint stocks primed for growth. We also extracted companies that had an ‘artificially’ high upside potential due to plummeting share prices.

The result: 10 top stocks with big support from the Street’s best analysts. These are the analysts that consistently crush the market. Here we look at five of these top stocks- and we will publish five more in our next blog post.

So now let’s dive in and take a closer look at these five stocks- all of which share a ‘Strong Buy’ analyst consensus:

1. Heron Therapeutics (Nasdaq: HRTX)

This innovative biopharma has huge upside potential of 130% according to the Street. And this year HRTX has received only buy ratings from analysts and top analysts alike. Heron specializes in post-surgical pain management and drug delivery.

Cowen & Co analyst Boris Peaker calls Heron the Best Idea for 2018. He believes the stock has room to grow with several catalysts in 2018 that can provide significant upside. This includes HTX-011 Phase 3 data in 1H18 and commercial progress with Sustol and Civanti. According to Peaker, HTX-011 has a shot at becoming the best-in-class opioid alternative for post-surgical-pain. He has a $40 price target on the stock (158% upside). Note that you can click on the Top Stocks screenshot below for further stock insights.

Leave A Comment