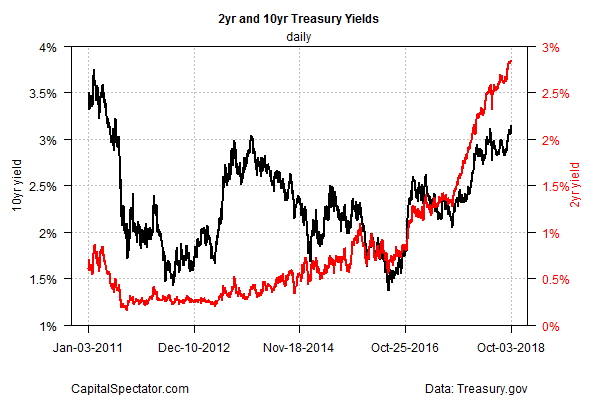

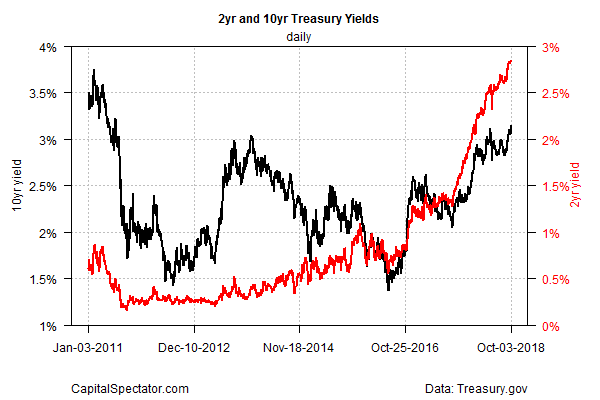

If there was any doubt that a regime of rising interest rates has arrived, the Treasury market on Wednesday dispatched a wake-up call.

The benchmark 10-year yield jumped ten basis points to 3.15% on Wednesday – the highest level since 2011 via the biggest daily increase in nearly two years. The policy sensitive 2-year rate edged higher, too, increasing to 2.85%, the highest since early 2008.

Bullish economic news is a key factor in lifting rates. Yesterday’s ADP Employment Report was surprisingly strong. Economists were expecting a gain of 179,000 jobs for September, according to Econoday.com’s consensus forecast; the actual increase is 230,000. Notably, the year-over-year trend strengthened: private payrolls rose 2.0% through last month, the strongest advance in over four years.

The ADP data strongly suggests that Labor Department’s September update on nonfarm payrolls tomorrow will deliver upbeat numbers too. If yesterday’s release is a guide, Econoday.com’s consensus forecast for a gain of 175,000 in private-sector jobs in Friday’s release looks set for an upside surprise.

Yesterday’s sentiment numbers for the US services sector added to the bullish aura, based on the ISM Non-Manufacturing Index for September. This gauge jumped to the highest level on record (albeit for a history that only dates to 2008).

“The continued strength of the [ISM data] implies that growth is set to remain well above trend,” advised Andrew Hunter, US economist for Capital Economics. “That will keep the Fed raising interest rates steadily in the near term.”

The competing Services PMI didn’t confirm the hot ISM print. Instead, the PMI dipped to an eight-month low in September. “Service sector business growth has eased considerably since peaking back in May, but remains relatively solid,” notedChris Williamson, chief business economist at IHS Markit. “Some of the slowdown can be traced to capacity constraints, with new business once again rising at a steeper rate than firms were able to boost output.”

Leave A Comment