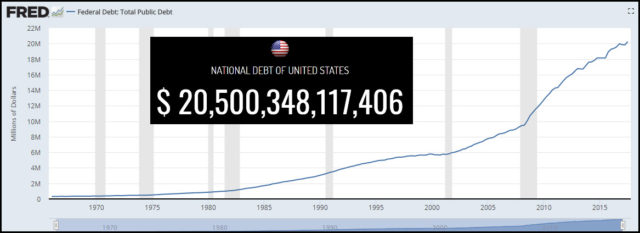

Is the bond bull market of the past 30-years over? Are we seeing just the start of a trend higher in interest rates or are they about to blast off? This isn’t the million dollar question, its the “Trillion Dollar” question as U.S. Government debt continues to skyrocket.

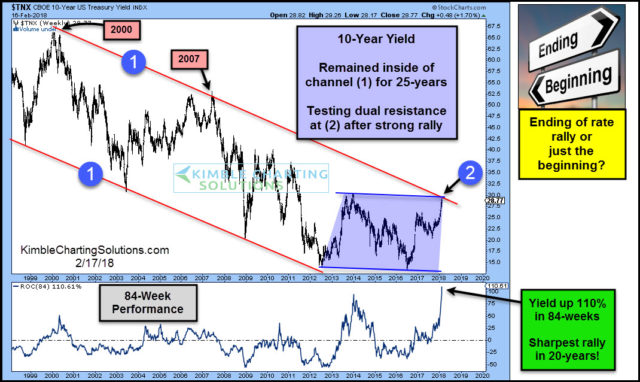

Below takes a long-term look at the yield on the 10-year note (TNX) as well as a look at how large of an increase in rates have taken place over the past 84-weeks

The yield on the 10-year note is up 110% over the past 84-weeks, which is the largest yield rally in this short of a time period in a couple of decades. This sharp rally now has yields testing the top of a 25-year falling channel as well as at the top of its 5-year trading range at (2). Is the just the beginning in a rate rise of a short-term ending?

Below takes a peek at what hedgers are doing in the 10-year Treasury Note from Sentimentrader.com

Hedgers look to have a crowded trade in play at this time. Over the past 10-years when they were positioned like this, the 10-year note was more often closer to a short-term low than high. Will it be different this time?

With the U.S. Government debt now exceeding $20 Trillion, what the 10-year note does at the top of its 25-year rising channel, is very important friends!!!

Leave A Comment