My Swing Trading Approach

Still 100% cash today. If I do trade today, whether long or short, it will be small increments.

Indicators

Industries to Watch Today

Only Real Estate and Utilities managed to avoid losses yesterday. Technology led the way to the downside. Energy appears ready to test the February closing lows. Defensive looks ready to break below the February lows

My Market Sentiment

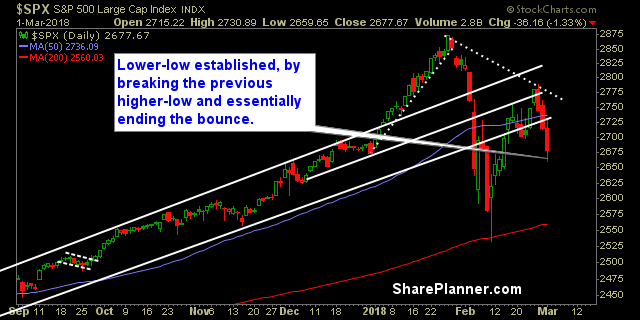

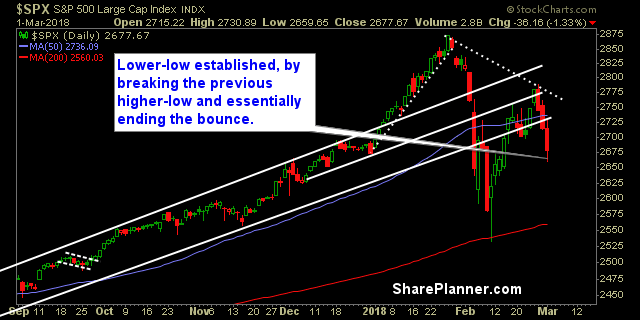

I wouldn’t be surprised if the market found a bottom at some point today, and then engages in a relief bounce, following three straight days of selling. Yesterday’s break of the February 22nd lows was not ideal for SPX, and ultimately it probably goes lower.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment