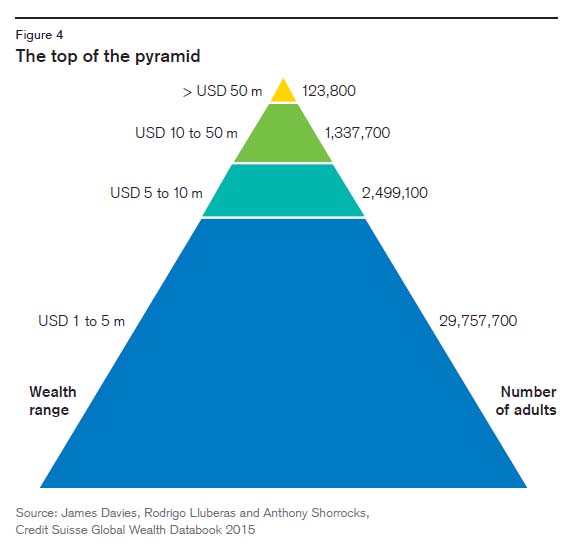

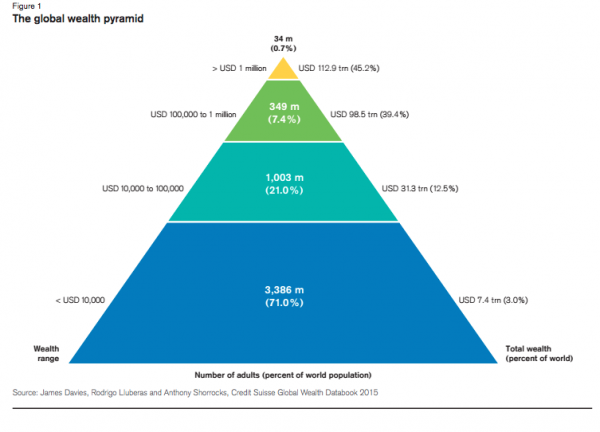

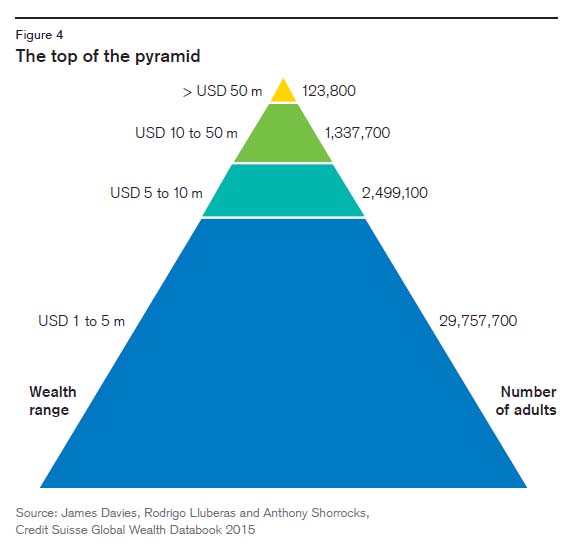

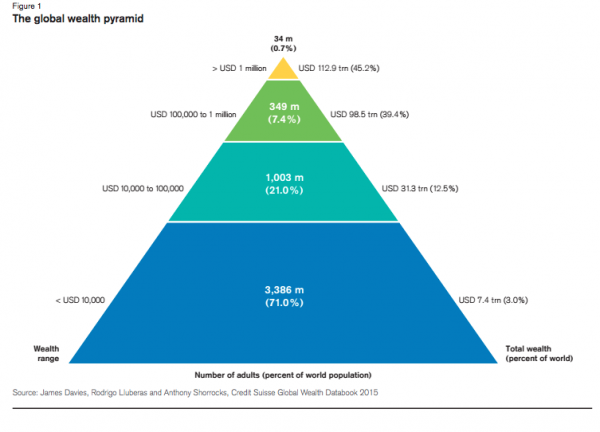

With another year of QE almost in the history books, we were looking for some great examples of how wealth disparity in the US between the pinnacle of the “wealth pyramid”, shown below and everyone else.

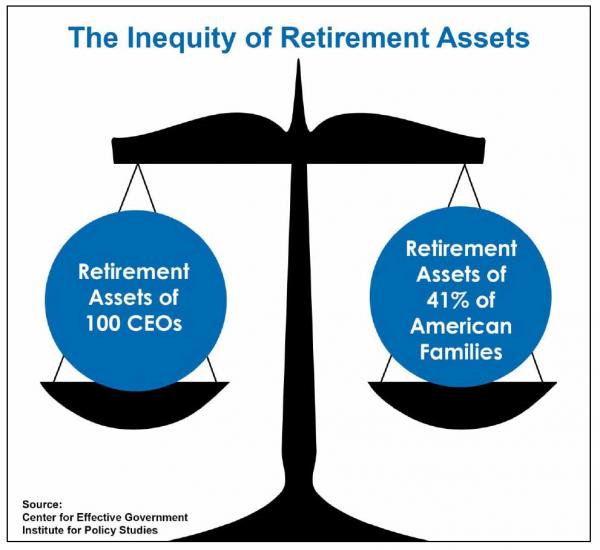

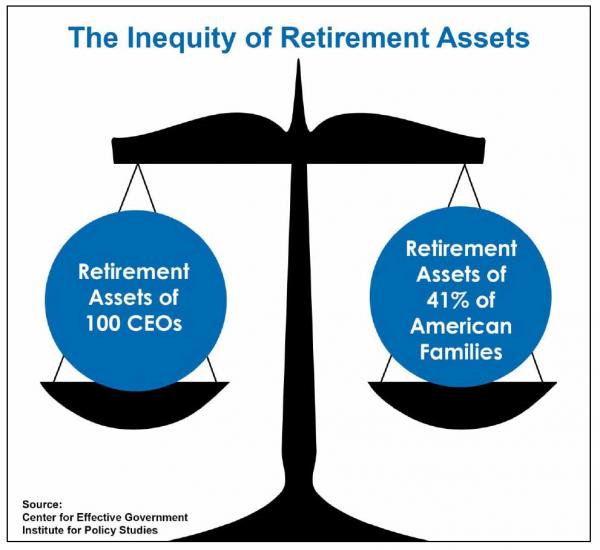

We got it thanks to a study by the Center for Effective Government and Institute for Policy Studies called “A Tale of Two Retirements”, which found that company-sponsored retirement assets of just 100 CEOs are equal to those of more than 40 percent of American families, roughly 50 million families or 116 million people.

Here are the findings which indicate a wealth divide so wide it could make Marie Antoinette blush:

The 100 largest CEO retirement funds are worth a combined $4.9 billion. That’s equal to the entire retirement account savings of 41 percent of American families – more than 50 million families and more than 116 million people.

On average, the CEOs’ nest eggs are worth more than $49.3 million, enough to generate a $277,686 monthly retirement check for the rest of their lives.

David Novak of YUM Brands had the largest retirement nest egg in the Fortune 500 in 2014, with $234 million, while hundreds of thousands of his Taco Bell, Pizza Hut, and KFC employees have no company retirement assets whatsoever. Novak transitioned from CEO to Executive Chairman in 2015.

The rich are not only richer, they are also legally allowed to pay far less taxes than most mere mortals: Fortune 500 CEOs have $3.2 billion in special tax-deferred compensation accounts that are exempt from the annual contribution limits imposed on ordinary 401(k)s.

Fortune 500 CEOs saved $78 million on their 2014 tax bills by putting $197 million more in these tax-deferred accounts than they could have if they were subject to the same rules as other workers. These special accounts grow tax-free until the executives retire and begin to withdraw the funds.

The Fortune 500 CEOs had more in their company-sponsored deferred compensation accounts than 53.8 percent of American families had in their deferred compensation accounts.

Glenn Renwick, CEO of The Progressive Corporation, transferred $26.2 million of his pay into his deferred compensation account last year, the most of any Fortune 500 CEO. That reduced his income tax bill by more than $10 million in 2014.

Leave A Comment