Colgate (CL) has been one of the most successful dividend growth stocks over the last few decades and is one we are watching closely for our Top 20 Dividend Stocks portfolio.

Like many other consumer staples businesses, CL benefits from strong brands, dominant market share positions, and financial strength to invest heavily in new product innovation and marketing. The company appears to be very well positioned for long-term earnings growth, and its dividend is one of the best that income investors can find – very few companies can claim uninterrupted dividends since the late 1890s!

With that said, the company is facing some macro headwinds today, and the stock’s multiple is relatively high. Let’s take a closer look.

Business Overview

CL has been in business for more than 200 years and focuses on four consumer categories – oral care (46% of sales – toothpaste, mouthwash, toothbrushes), personal care (21% – shower gel, body lotion, liquid hand soap, bar soaps), pet nutrition (13% – specialty pet food), and home care (20% – household cleaners, liquid fabric conditioners, hand dishwashing soap).

Some of the company’s most well-known brands include Colgate, Palmolive, Protex, Speed Stick, Ajax, Irish Spring, Sanex, Hill’s, and Softsoap.

The company’s products are sold in over 220 countries, with about half of sales coming from emerging markets and over 80% of sales coming from outside of the United States. CL has operated in most of its current markets for more than 70 years.

Business Analysis

CL has been in business for a long time. William Colgate started a starch, soap, and candle business in New York City in 1806, nearly 210 years ago. The company’s first toothpaste was introduced in jars during the early 1870s and moved into a collapsible tube in 1896.

Why does any of this matter? We think one of CL’s competitive advantages is the cumulative knowledgebase it has built up over the company’s lifetime. Over two centuries of R&D, marketing expertise, consumer insights, branding, distribution relationships, and much more have been accumulated.

Perhaps equally important, CL has been in key emerging markets for a long time as well. For example, the company entered Mexico in 1925, Brazil in 1927, and India in 1937. This long-lasting presence has certainly helped CL understand these consumers well and tweak its brands and products to meet these consumers’ needs very well.

Like we have discussed with Kimberly-Clark and General Mills, shelf space is another major advantage that incumbents have in the consumer staples sector. Retail customers want products that they know will sell and be invested in by the manufacturer in the form of expensive in-store displays, product packaging, and marketing campaigns. Taking a risk on new products from much smaller companies often provides little upside.

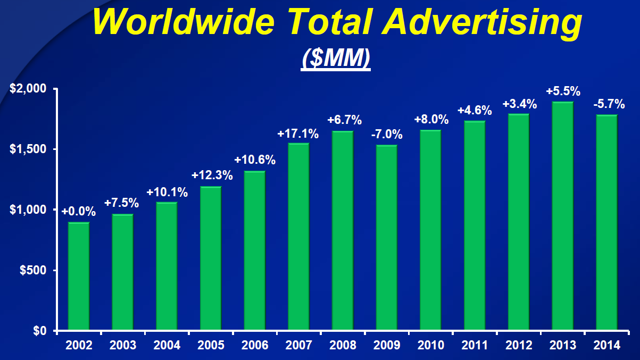

CL invests heavily to stay ahead of trends in its markets, which are slow-changing to begin with. The company invested $277 million in R&D last year and dropped nearly $1.8 billion on advertising. These investments ensure that the company’s products continue to meet evolving consumer needs and remain in the forefront of their minds as they shop. As seen below, CL has been relentless with its advertising spending, creating strong brands the new entrants will have a very hard time challenging.

Source: Colgate Investor Presentation

Altogether, CL’s longevity, effective R&D and marketing investments, and high quality management have allowed the company to dominate most of the markets it competes in. CL is #1 in toothpaste (45% global market share; more than 3x greater than its next biggest competitor and up from 35% in 1995; share is highest in many emerging markets – Mexico 81%, Brazil 72%); #2 in mouthwash; #1 in manual toothbrushes; #1 in liquid handsoap, #1 in liquid fabric conditioners; #2 in bar soaps and liquid body cleaning; #2 in hand dishwashing and household cleaners; and #1 in pet food sold through vet clinics.

Leave A Comment