If all goes well for nine more months, the post-financial crisis economic expansion will become the longest economic expansion in recent U.S. history. The U.S. stock markets are also on a tear, having just become the longest bull market since World War II. Regardless of your views about these trends continuing, the fact of the matter is that they are both much closer to ending than a beginning. Ray Dalio recently quantified this continuum, declaring that the economy is in the 7th inning, implying another one to three years of continuation.

While the markets can certainly keep motoring ahead, as Dalio and many others expect, there are some factors supporting the bullish case that investors should contemplate.

While this list is not by any means exhaustive, it does offer many of the most important assumptions supporting the market and some details to provide context and clarity.

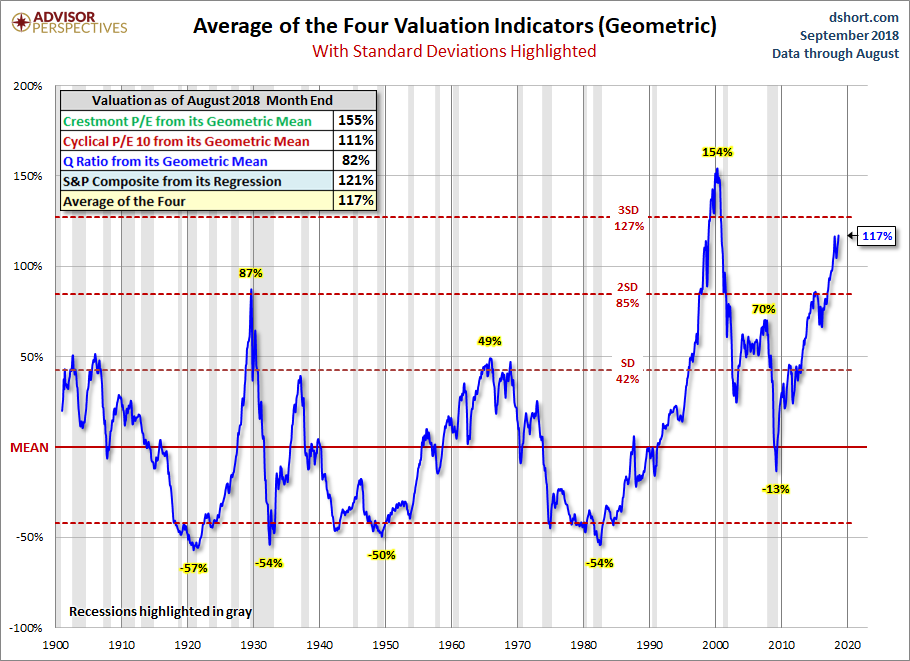

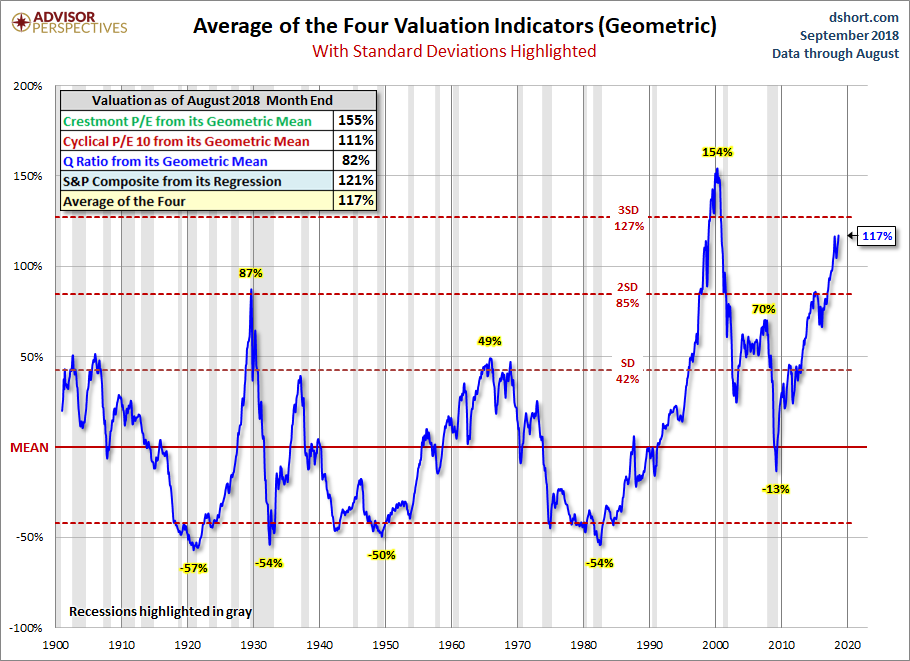

1. Corporate managers have become so adept at their jobs that profit margins and equity valuations will remain at, or rise from current nearly unprecedented levels.

Market Cap: GDP – 99% historical percentile according to Goldman Sachs Investment Research (GS)

Enterprise Value-to-Sales – 97% historical percentile (GS)

Shiller’s CAPE 10 – 90% historical percentile (GS)

Price-to-Book Value – 89% historical percentile (GS)

John Hussman’s margin-adjusted CAPE – Record high including 1929 and 1999.

Expected 10 year S&P 500 return as depicted in our article Allocating on Blind Faith is negative

GMO 7-Year real return forecast -4.90% for U.S. large cap, -2.30% for U.S. small cap and -3.80% for U.S. high quality

Doug Short’s (Advisor Perspectives) Average of the Four Valuation Indicators is 117% overvalued as shown below and nearly 3 standard deviations from the mean

2. Bond yields will remain historically low and the 30-year downward trend will not reverse

The 10-year U.S Treasury yield is slightly above a key 30-year resistance line at 3.11%

The 30- and 10-year U.S. Treasury yields are testing multi-year highs of 3.23% and 3.12% respectively

Since the lows of 0.70% in November 2016, the 2-year U.S. Treasury yield has risen 300% to 2.80%

3-month LIBOR, a key global interest rate for floating rate financing, has risen 282% from 0.62% in June 2016 to the current level of 2.37%

Implied volatility on Treasury note futures is at historically low levels indicating extreme complacency

GMO’s 7-Year real return forecast is -0.20% for US bonds

Leave A Comment