Show of hands: who’s looking forward to earnings season?

Although the increasingly permabull-ish punditry is fond of plotting earnings growth with the S&P in a largely fruitless effort to “debunk” what they swear is a “conspiracy theory” about central bank largesse leading directly to gains in global risk assets, the irony is that these very same pundits overwhelmingly think there’s little utility in paying attention to fundamentals.

After all, it’s the very same people who persist in the whole “it’s the earnings growth not the QE” fantasy that will tell you to keep buying at historically elevated multiples via passive index funds which, by virtue of being passive index funds, indiscriminately funnel your money into the market with no regard whatsoever for the fundamentals. Maybe the pundits can explain that rather glaring inconsistency in what for them counts as “logic.”

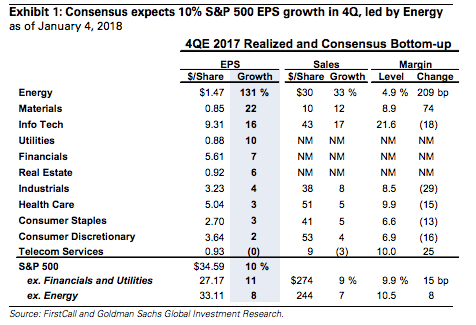

Anyway, that turned into an agitated rant (who’s surprised?). The whole reason I sat down to pen this brief post was to point out that, as Goldman writes on Friday evening, “consensus expects S&P 500 y/y EPS growth of 10% in 4Q, a rebound from the 7% growth in 3Q [and] ex-Energy, S&P 500 earnings are expected to grow by 8% versus 4Q 2016.” Here’s the chart:

Here’s the thing though. According to Goldman, you should probably just go ahead and ignore Q4. I mean, obviously they don’t put it in quite those terms, but that’s the gist of it. To wit:

We expect investors will largely look through 4Q results and focus on the impact of tax reform on 2018 EPS. The Tax Cuts and Jobs Act was signed by President Trump on December 22, 2017. As a result, companies are likely to take certain charges this quarter and the noisy 4Q results will muddy underlying company fundamentals. Furthermore, many analysts may exclude these one-time charges from adjusted EPS. For companies only reporting GAAP EPS, the headline impact could be substantial

Leave A Comment