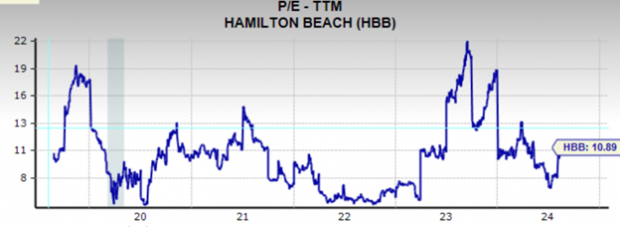

Consumer spending in the US has been a mixed bag based on the types of goods and services, but in general the consumer has proved fairly resilient despite inflationary pressures and the substantial increase in interest rates since the tightening period began.Zacks recently upgraded 2 small caps, Hamilton Beach Brands Holding Company and Armanino Foods of Distinction , Inc.), from Neutral to Outperform. Both companies reported marked operating improvements in Q2 but also rely on discretionary consumer spending.Hamilton Beach makes branded electric appliances for household and commercial use, with 2023 sales of $626 million and a market capitalization of about $380 million. The stock has had an impressive run lately, up +57% over the past year, handily outperforming the Zacks Consumer Discretionary sector’s roughly flat returns over the period. Hamilton Beach’s (HBB) sales grew 14% year-over-year (YOY) in Q2 as the designer of small kitchen appliances continues to execute on its sales strategy which includes successful penetration into the higher margin premium products category. Products include air fryers, blenders, coffee makers, juicers, mixers, etc.While the company expects a more subdued YOY performance in the second half of 2024 due to tough comps, we believe the forward valuation, strong free cash flow generation (FCF), lower interest expense from material debt reduction, and proven market penetration outweigh topline softening risks. Hamilton Beach shares are currently trading at 10.9X trailing 12-month earnings. This compares to a high of 22.1X, low of 4.9X and median of 9.9X over the preceding 5-year period, as the chart below shows.  Image Source: Zacks Investment ResearchArmanino Foods of Distinction, Inc. (AMNF) produces frozen and refrigerated food products including pesto flavors, specialty sauces, frozen pasta, meatballs, and prepared meals. Sales grew 16% YOY in Q2 while operating income improved 90% YOY due to reduced commodity prices and improved manufacturing process efficiencies. We expect the company to continue to benefit in the near term from these conditions. Additionally, the company has recently expanded into the Texas market with hopes of duplicating their leading brand success experienced in certain California markets.With a market cap of $180 m, the company has generated $63 m of sales over the past 12 months. The stock is up 16.7% YTD vs. 1.1% for the Zacks food industry.Armanino Foods of Distinction shares are currently trading at 16.5X trailing 12-month earnings as the chart below displays. Over the last 5 years the stock has traded as high as 58.83X and as low as 10.3X. The median over this time-frame is 18.5X.

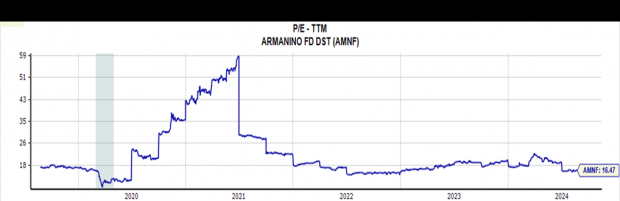

Image Source: Zacks Investment ResearchArmanino Foods of Distinction, Inc. (AMNF) produces frozen and refrigerated food products including pesto flavors, specialty sauces, frozen pasta, meatballs, and prepared meals. Sales grew 16% YOY in Q2 while operating income improved 90% YOY due to reduced commodity prices and improved manufacturing process efficiencies. We expect the company to continue to benefit in the near term from these conditions. Additionally, the company has recently expanded into the Texas market with hopes of duplicating their leading brand success experienced in certain California markets.With a market cap of $180 m, the company has generated $63 m of sales over the past 12 months. The stock is up 16.7% YTD vs. 1.1% for the Zacks food industry.Armanino Foods of Distinction shares are currently trading at 16.5X trailing 12-month earnings as the chart below displays. Over the last 5 years the stock has traded as high as 58.83X and as low as 10.3X. The median over this time-frame is 18.5X.  Image Source: Zacks Investment ResearchWhile both companies have expressed a degree of caution about the state of the consumer, we don’t foresee topline imploding. Thus far their respective product categories have demonstrated consumer spending resiliency while also successfully executing on new strategies i.e. new market penetration with improved balance sheets. Forward looking valuations appear reasonable, in our opinion. Please note that both companies also offer dividend yields of 2.6% and 1.7% respectively for Armanino Foods and Hamilton Beach. Lastly, both companies may benefit from a lower interest rate environment down the road. More By This Author:3 Highly Ranked REITs To Buy With Rate Cuts AheadNvidia: The Path To $10 Trillion Bear Of The Day: Bowlero

Image Source: Zacks Investment ResearchWhile both companies have expressed a degree of caution about the state of the consumer, we don’t foresee topline imploding. Thus far their respective product categories have demonstrated consumer spending resiliency while also successfully executing on new strategies i.e. new market penetration with improved balance sheets. Forward looking valuations appear reasonable, in our opinion. Please note that both companies also offer dividend yields of 2.6% and 1.7% respectively for Armanino Foods and Hamilton Beach. Lastly, both companies may benefit from a lower interest rate environment down the road. More By This Author:3 Highly Ranked REITs To Buy With Rate Cuts AheadNvidia: The Path To $10 Trillion Bear Of The Day: Bowlero

Leave A Comment