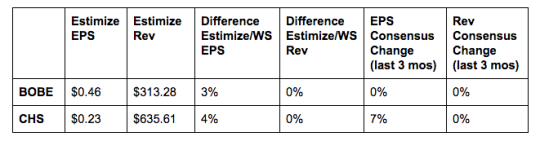

Bob Evans Restaurants (BOBE): The restaurant chain has fallen victim to changing consumer dining preferences. While earnings have beaten expectations in recent quarters, revenue has been sideways for almost 2 years now. The stock has been just as tepid, falling 11% in the past 12 months and nearly flat year to date. Early indications suggest tomorrow’s results will fall in line with recent performances. Management remains focused on returning to profitability in with both BEF Foods and its namesake Bob Evans Restaurants. This involves improving efficiency across the board and closing the doors on unprofitable locations. BOBE recently announced they would be closing 47 locations of the nearly 530 total units in operation. A surprise Q1 report tomorrow could set a favorable tone to the start of its fiscal 2017.

Chico’s (CHS): Apparel retailers like Chico’s have had trouble keeping pace with online retailer and fast fashion trends. Earnings have as a result suffered with the past 3 quarters delivering negative growth on both the top and bottom line. The quarter to be reported is projected to continue this ongoing trend into negative territory. Soft sales have been driven largely by increasing competition and weak traffic trends. Chico’s believes upgrading its supply chain and marketing initiatives will enable the company to meet evolving customer demands. Many other mall based brands such as Abercrombie and Gap have already reported significant misses this quarter which makes a potential beat that much more rewarding.

Leave A Comment