Silly, hyperbolic title aside, that is my gain for 2016 when backing out the fact that I have been generally around 90% cash and Treasury bond equivalents while being long and short stocks with the other 10%. It does not include a long-term gold position, which I don’t count as a capital appreciation (or loss) vehicle. I count it as long-term value, whether it’s marked up or marked down.

So really, I am about +2% for 2016 with the 20% being an ‘all in’ (in this case to my 10% exposure) figure like the average mutual fund or even more so, the average indexed fund goes all in with the kitchen sink. But I was curious about the performance of the capital I have decided to risk over the first 2+ months and I’d have to say that I am pretty pleased.

The gold miners are no longer in ‘low risk’ territory, nor is gold. The stock market is at high risk but at a gateway to higher prices if it does not turn down soon. I don’t plan to be 0% to 10% exposed forever. But I was caught somewhat by surprise by the miners, so it’s not like I saw the January low as a low risk buying opportunity. There was no technical basis for that (although the funda were improving as noted over the last 6 months) since the head fake below HUI 100 opened a door, ever so briefly, to much lower potential prices. So I have traded the miners on this rally, but was not inclined to be a table pounding bull, especially since a bull market is not yet technically indicated. Still the miners did their part in the gains for 2016.

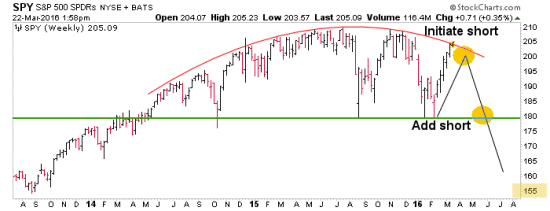

In the stock market I am seeking balance, picking out sectors and stocks I think have upside and holding a short on SPY per this annoying chart, which is poking above the dome this week.

I am more long than short, and all I want is direction from the stock market and low risk opportunity in the gold sector in order to get more involved. Neither of those are the case yet. So I’ll continue to work the 10% until the situation clears.

Leave A Comment