On Friday, the market immediately tumbled from its earlier highs when Fed Chair Janet Yellen said:

“In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.”

Many higher yielding REITs were hit particularly hard by the prospect of higher rates because it may soon be more expensive for them to borrow the money required to operate their businesses, and because rising rates may shift investor demand to other income generating opportunities. We ran a screen to identify stocks yielding over 6% (we also required a minimum $500 million market capitalization and at least $250 million in annual sales) and there were 20+ REITs in the results. Of the 20+ REITs, we believe three in particular are worth considering because of their well-managed balance sheets and compelling long-term strategies.

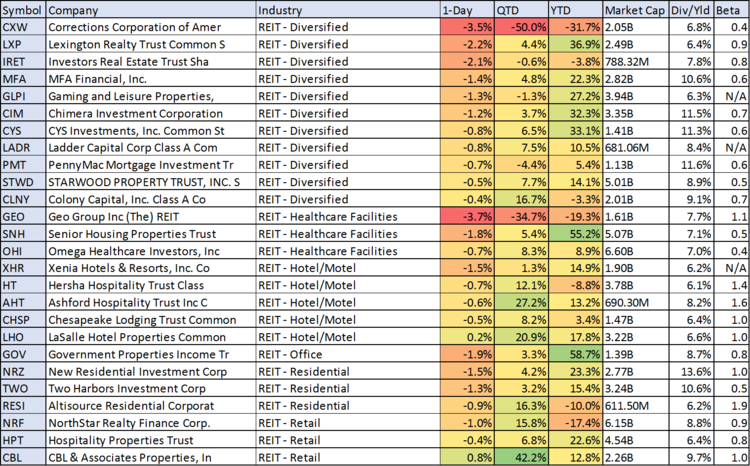

The following table shows the REIT results of the 6% yield screen we described previously, and many of them were down sharply on Friday following Janet Yellen’s hawkish tone.

Of these 20+ REITs, we believe three in particular are worth considering.

Lexington Realty Trust:

Lexington Realty Trust (LXP) is a higher yield (6.4%) self-managed and self-administered REIT that owns a portfolio of equity and debt investments in single-tenant properties and land. It was also down 2.2% on Friday following the Yellen’s statement. We consider Lexington attractive for a variety of reasons including its manageable debt load, its low FFO payout ratio, its low price to FFO ratio, its diversified investment portfolio, and its laddered lease maturities.

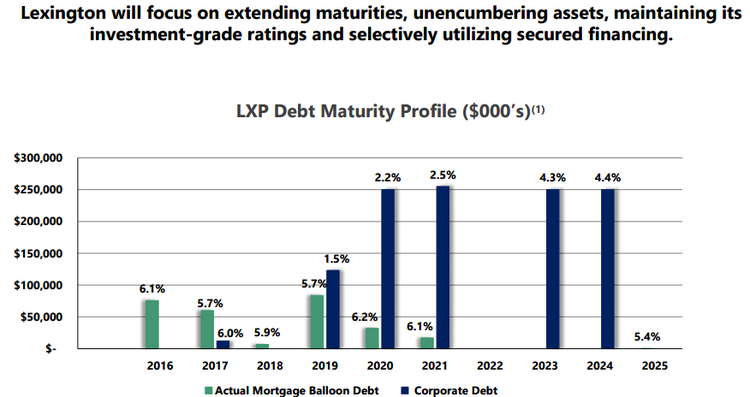

For example, the following table shows Lexington’s debt maturity profile and describes efforts to manage its exposures.

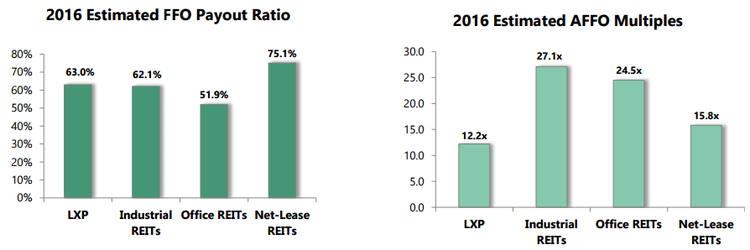

Also attractive, Lexington has a low FFO payout ratio, and a relatively attractive price to FFO ratio.

Additionally, Lexington’s investments are well-diversified without any overly concentrated exposure to a single tenant.

Leave A Comment