Investors are likely feeling emboldened by the strength of stocks as we close out the final month of 2016. Bullish enthusiasm can be infectious and now the race is on to determine which sectors or regions will be the top-performing areas of the market in 2017. While there is no way to know where the winner will be ahead of time, there is one noteworthy area that has piqued my interest – emerging markets.

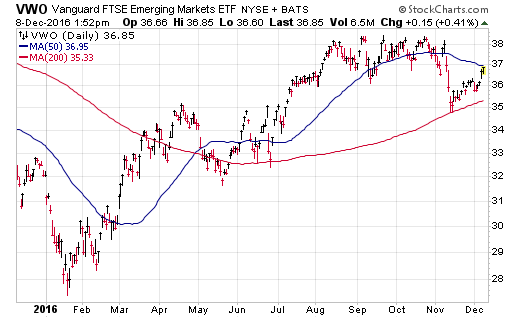

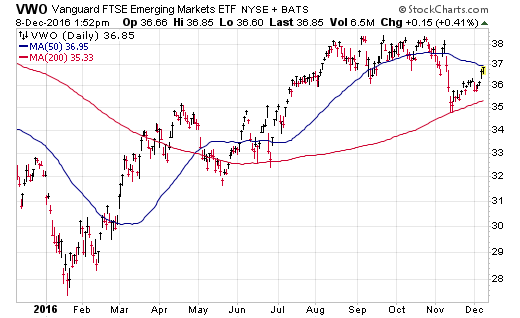

As many of my readers know, I have been very cautious about international exposure for quite some time now. All the momentum has truly been with the broader U.S. stock market and emerging nations have demonstrated a multi-year underperformance cycle. Nevertheless, the chart of the Vanguard FTSE Emerging Market ETF (VWO) has demonstrated several positive attributes over the last twelve months that are worth taking note of.

VWO is made up of a diversified portfolio of over 4,200 stocks of emerging market countries. This multi-cap index is dominated by China (28%), Taiwan (15.5%), and India (11.8%). Furthermore, VWO charges just a minimal 0.15% expense ratio for access to a truly broad index of international stocks.

Here are some of the things I like about VWO right now:

Leave A Comment