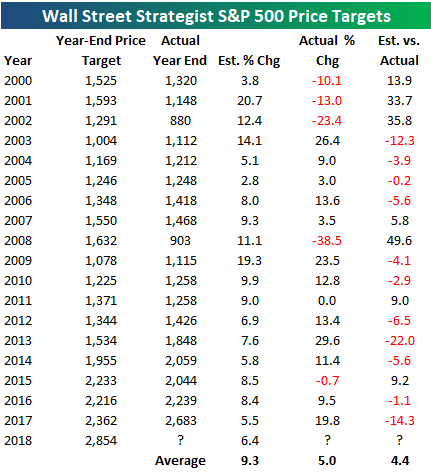

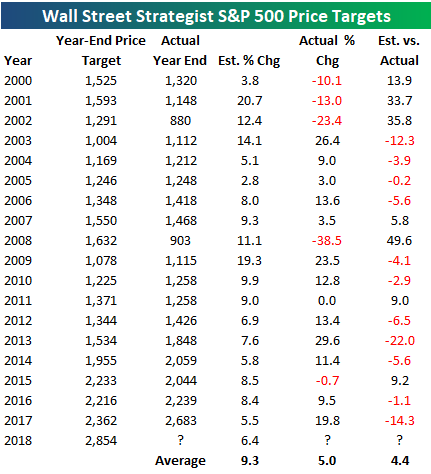

At the end of each year, we always like to take a look at where Wall Street strategists think the S&P 500 is headed over the next year.According to Bloomberg, the consensus S&P 500 price target for the end of 2018 stands at 2,854.That would represent a 2018 gain of roughly 6%.

Below, is a look at consensus year-end price targets for the S&P 500 for every year going back to 2000.For each year, we show where Wall Street strategists saw the S&P 500 trading at the end of the year, the estimated annual percentage change based on the price target, and the actual percentage change that the S&P 500 experienced that year.

Typically strategists project a gain of 9.3% for the S&P 500.That’s not surprising given that the S&P has historically averaged an annual gain of about that amount.In 2016, Wall Street strategists were spot on with their year-end target, missing the actual mark by just 1.1 percentage points.In 2017, however, strategists severely underestimated things.While they were looking for a gain of 5.5% this year, they undershot the actual mark by roughly 14 percentage points.

Underestimating is something strategists have done for most of this bull market.In the 9 years since 2009, strategists underestimated the actual move 7 times.

Also, notice that since 2000 there hasn’t been a year where the consensus year-end price target was negative.

With a price target that suggests a gain of roughly 6% in 2018, strategists are slightly more pessimistic than normal given that their average target over the years has called for a gain of 9.3%.

Leave A Comment