Global Equities & EM Debt Should Have A Solid 2018

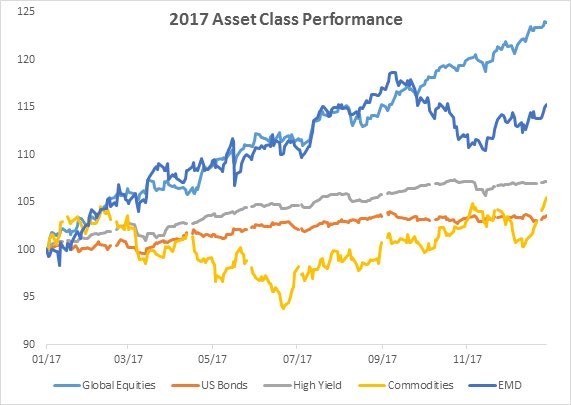

The chart below shows the major asset classes’ performance in 2017. Global equities were up 23.9%. I expect a smaller increase this year because equities in many markets were left for dead in 2016. Optimism is now high, meaning it’s tougher to meet expectations. Even if growth accelerates, there’s less room for outperformance.

Emerging market debt had a correction in September and October, but still ended the year up 15.3%. The Indian economy is expected to have a sharp rebound in 2018. The expectations for China aren’t high. As a whole, the improvement in emerging markets is expected to continue. I see the same situation for them as stocks. Heightened expectations limiting upside, but decent performance because of economic improvement.

High Yield Debt Is Risky Because Of QE Tightening

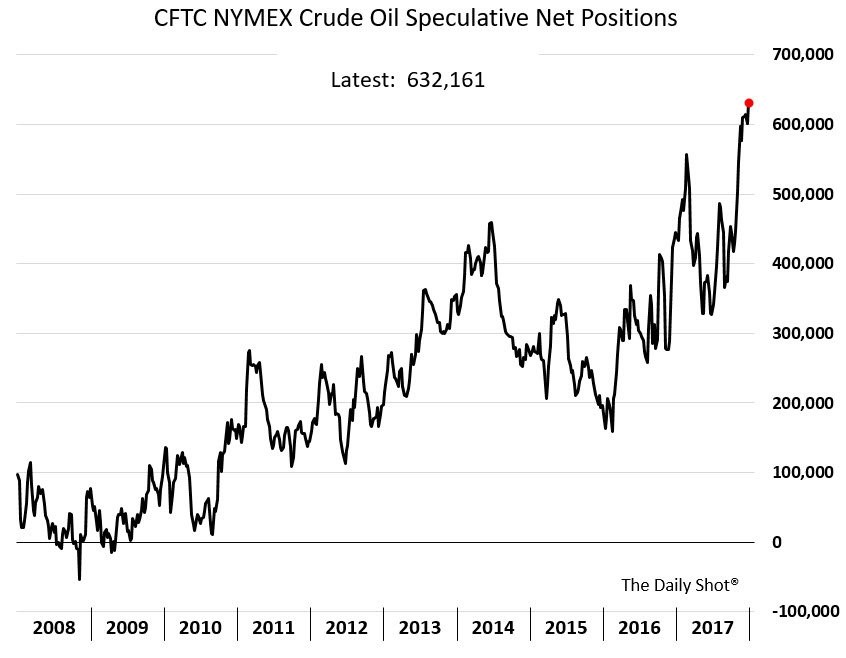

High yield debt was up 7.2%. I think this sector has the highest likelihood of a reversal. With the ECB ending its bond buying program and the Fed unwinding its balance sheet at a quicker pace, I could see high yield debt performing badly. The one saving grace could be that the energy firms dominate the high yield debt market. Since I expect energy and commodities to do well, this can help some of the high yield debt indexes that have a high energy and mining weight. The chart below is a long term historical reference point for speculation in crude. It’s important to show that there has been a long term uptrend, which means you shouldn’t get too pessimistic about the long speculation. I’m expecting a short pullback in January, but nothing close to the decline in 2014 to 2015. The fact that energy stocks haven’t followed crude, might be evidence a decline to the low $50s in WTI is likely.

Commodities Should Be Helped By Economic Growth

As I just mentioned, commodities should do better than their 5.5% increase in 2017. They already showed signs of life in December after having poor performance in the first 11 months of the year. Commodities prices usually increase when economic growth accelerates. The U.S. tax cuts should improve American’s demand for most commodities. It’s interesting to see how JP Morgan now thinks GDP growth can reach 3% in 2018 because most economists said that was impossible a couple years ago. Nothing changes predictions like near term momentum. The 3.2% growth rate in Q3 GDP along with the tax cuts are enough for economists to change their minds. I’m not saying this is a bad prediction. I’m merely emphasizing how shortsighted predictions can be. JP Morgan strategist David Kelly sees one year of 3% growth and then a return to 2% growth. Economists are still hesitant. Once we see them going all out in their predictions after a fast paced 2018, we’ll know the cycle is near its end.

Leave A Comment