This is a traders’ market.

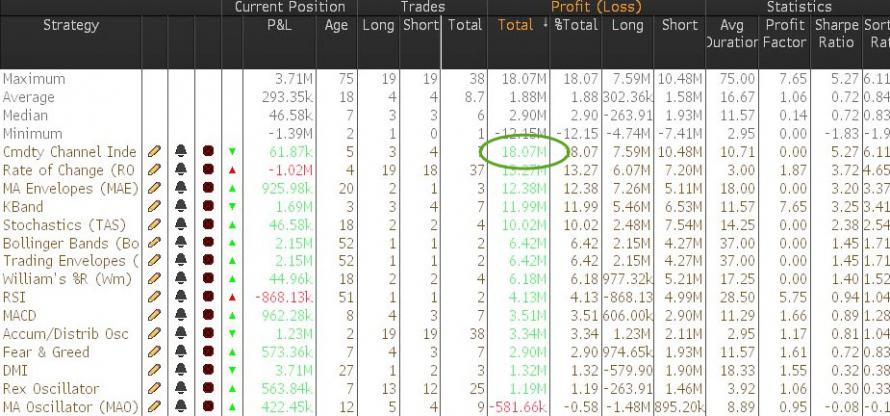

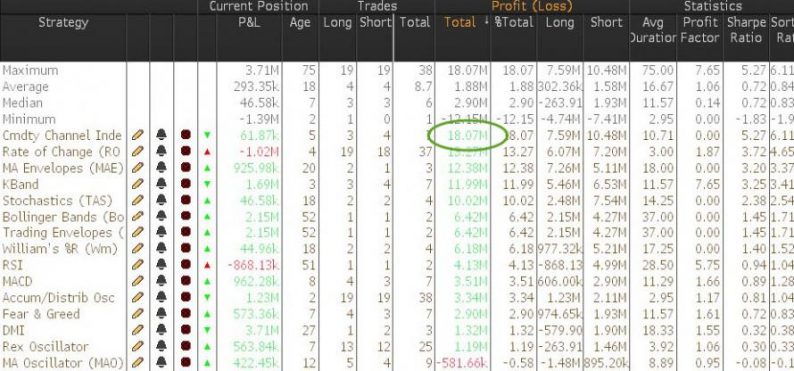

That’s why a rule-based trading strategy based on the Commodity Channel Index has gained 18% this year, despite a flat S&P 500.

It is the most profitable strategy among various technical indicators Bloomberg tracks.

The strategy is simple.

It sells the S&P 500 when the CMCI index crosses below 100 from above, and buys stocks when it rises above -100 from below.

It is essentially a bet on a trend reversal and against momentum.

The strategy has generated seven trades this year with a 100% success ratio.

It has had a sell signal since April 16.

Of course, past performance is no guarantee of future returns. And this week felt painful for anyone who sold stocks last week (until today)… If anything, betting on a trend reversal has been lucrative, given the volatility we are witnessing.

Leave A Comment