While demand for US Treasurys remains brisk at primary auctions (if more questionable in the secondary market where we recently learned that Russia liquidated virtually all of its Treasury holdings, in May), the same can hardly be said for the short-end of the market, where moments ago we saw what happens to auction demand in a time of rapidly rising rates and rising supply.

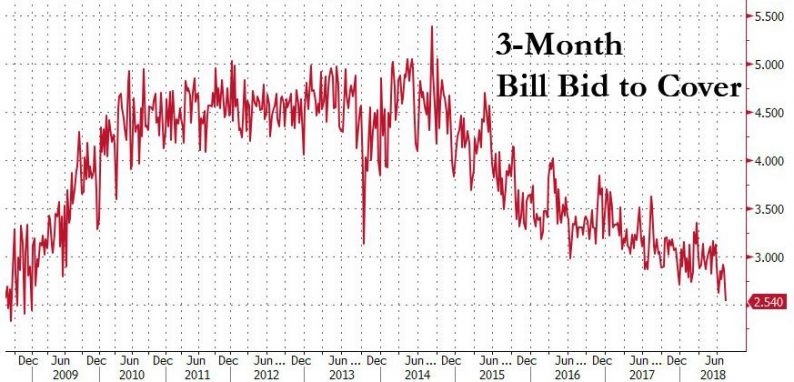

As shown in the chart below, while the yield on 3 Month Bills auctioned off today came in largely as expected at 2.010%, the demand did not, and after dropping to a cycle low Bid to Cover of 2.62 last month, today’s 3 Month (or 12 week) auction suffered from one of the lowest demands on record, tumbling to just 2.54 from 2.87 last week, with $129.7BN in bids tendered for $51BN in paper, down sharply from $146.2BN on July 30. In context, this was the lowest Bid To Cover in the past ten years, and one would have to go back all the way to the post-Lehman days of 2008 to find a lower BTC.

A similar plunge took place in the 6-Month Bill, where the Bid to Cover likewise plunged from 3.140 to 2.660 in just one week.

Meanwhile, supply is mounting, and on Tuesday the Treasury plans to sell $70b of 4-week paper, the most for the tenor on record, according to Treasury data since 2001, with the auction size set to eclipse the previous record of $65BN.

And with both T-Bill issuance set to grow as per the latest Treasury announcement, and rates set to rise for the foreseeable future, two things are certain: not only will the Libor-OIS spread resume widening amid the continued surge in short-term supply and increasingly tighter financial conditions, but demand will continue to slide, although the good news is that we are still well off from the record lows, in which auctions were only 2.0x covered at the start of the century. That said, who knows: perhaps the break in the bond market will begin with a failed Bill auction as the US Treasury finds it increasingly difficult to roll over short-term debt.

Leave A Comment