A full month has now passed since the Federal Reserve hiked interest rates for the first time since 2006. This development created a far different environment than many investors anticipated. In fact, many of the funds that were considered at the top of a rate hike “play book” need to be reconsidered in light of current market trends.

Let’s examine some of the foremost rate hike plays that have been touted since the taper tantrum of 2013.

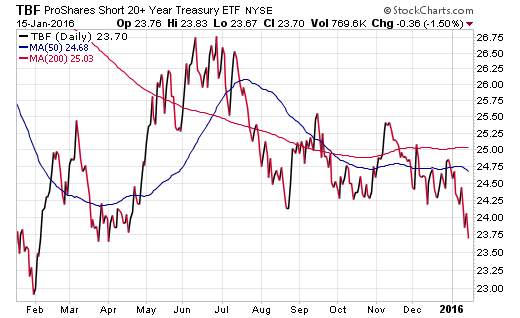

ProShares Short 20+ Year Treasury Bond ETF (TBF)

Most investors automatically associate rising interest rates with falling Treasury bond prices. Therefore, a fund like TBF, which shorts a basket of long-term Treasuries, should be a no brainer as the Fed tightens monetary policy.

Nevertheless, over the last month TBF has fallen 3.85% and continues to be mired in a pervasive downtrend. This ETF is below its long-term moving average and looks ready to test its 52-week lows in the near future as well.

What many underestimated in this trade is the volatility in stocks driving a traditional “flight to quality” in long-term Treasuries. In addition, the actual mechanics of an interest rate hike are all centered around the short end of the yield curve. This has little effect on the price of long duration bonds, which are driven by conventional market forces of buyers and sellers.

PowerShares Senior Loan Portfolio (BKLN)

Remember when senior loans and floating rate notes were going to be the cure to your rising rate woes? That thesis was predicated on the notion that these debt instruments were insulated from interest rate risk because of their adjustable duration component. This makes their effective duration very short as it floats in relation to a benchmark such as LIBOR.

However, the little-talked about risk in these securities is a contracting credit environment. A fund such as BKLN is sensitive to credit headwinds similarly to the iShares High Yield Corporate Bond ETF (HYG).

Leave A Comment