As explained in great detail in our Canadian bank stocks outlook for 2018 InvestingHaven is rather bullish on the Canadian banking sector for 2018. We believe Canadian banks will have a robust performance backed by the start of an environment of rising interest rates in Canada.

If (and that is a big IF) our forecast will be validated then it is important to buy and hold the sector leaders. This article explores 3 Canadian banking stocks which we identified as the outperformers for 2018 and later. Given the current state of the sector they are a BUY.

Note that any forecast can be invalidated, for sure if black swan events take place.

#1: RBC Royal Bank

RBC Royal Bank is Canada’s largest bank based on market capitalization. It is also ranked in the top 15 banks globally based on market cap and operates in 37 countries.

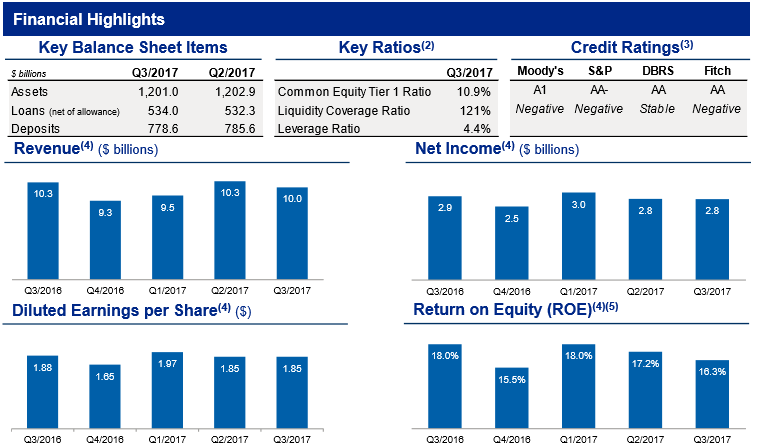

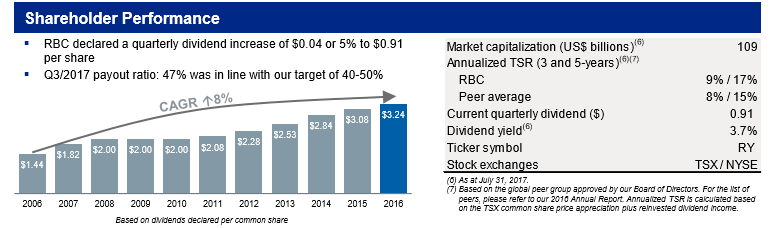

RBC made it to our top 3 canadian banks for 2018 for the following reasons:

With such a stellar balance sheet, RBC expects a boost in revenues with 2 recent rate hikes in Canada. According to Dave McKay, RBC’s CEO:

“I would say a 25-basis-point increase in rates should benefit our retail franchise in the first year roughly by C$100 million but increase to upwards of C$300 million by year five as it takes a while to blend into the portfolio,”

So the above figures x 2 as there were 2 25-basis-point increases.

A good example is the acquisition of City National in the US. We should see the pay out of this smart acquisition in 2018.

Leave A Comment