The drug development process is often lengthy and time-consuming and requires the utilization of a lot of funds and resources. It may well take a drug anything between 10-12 years to be successfully developed and reach the market. In such a scenario, key pipeline events including data readouts and regulatory updates are of paramount importance – companies which hit the bull’s eye become overnight success stories with shares even doubling or tripling on positive news while negative outcomes have an equally strong effect on the shares and failure may very well spell doom for these companies.

Here is a look at three stocks that have important regulatory events scheduled for this month.

Spectrum Pharmaceuticals, Inc.’s (SPPI – Free Report) new drug application for Qapzola (apaziquone) will be reviewed by an FDA advisory panel later this week. The FDA’s Oncologic Drugs Advisory Committee is meeting on Sep 14 to review the NDA – the proposed indication for the product is for the immediate intravesical instillation post-transurethral resection of bladder tumors in patients with non-muscle invasive bladder cancer.

Advisory panels provide the FDA with independent opinions and recommendations from outside experts on new drugs as well as FDA policies. While the agency is not required to do so, it usually follows the advisory committee’s recommendation. Therefore, FDA advisory panel meetings are closely followed by investors as they give an insight into the FDA’s final decision regarding the approval status of the candidate. A positive panel recommendation would be a major boost for Spectrum, a Zacks Rank #3 (Hold) stock.

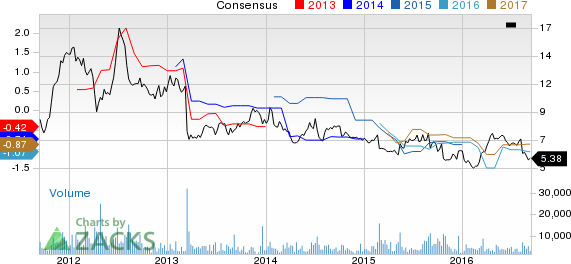

Price and Consensus

Next on the list is biotech major, Amgen Inc. (AMGN – Free Report) , which has an important regulatory event coming up later this month with the FDA expected to decide on the approval status of the company’s Biologics License Application (BLA) for ABP 501.

ABP 501 is a biosimilar candidate to AbbVie Inc.’s (ABBV – Free Report) Humira, an anti-tumor necrosis factor-alpha (TNF-?) monoclonal antibody, which is approved in many regions for the treatment of several inflammatory diseases. With an FDA advisory panel voting in favor of ABP 501 earlier this year, expectations are high that the FDA will give its nod to ABP 501 on the target action date of Sep 25, 2016.

Why is this approval important for Amgen? Well, Amgen is pretty committed to the biosimilars effort and if approved, ABP 501 would be the first biosimilar from Amgen’s pipeline to gain approval. The Zacks Rank #3 stock has quite a few biosimilars in development including biosimilar versions of cancer drugs, Avastin and Herceptin. Amgen has even tied up with Japanese company, Daiichi Sankyo, to commercialize nine biosimilars in Japan.

Last year, on an analyst call, Amgen had said that it expects to launch five new biosimilars between 2017 and 2019. The biosimilars opportunity represents annual revenues of more than $3 billion for Amgen. Humira brought in 2015 sales of $8.4 billion in the U.S. alone where the composition of matter patent is expected to expire in Dec 2016.

But even if it gains FDA approval, Amgen will have to take a decision regarding its launch plans for ABP 501 considering AbbVie has initiated a patent infringement lawsuit against the company.

Leave A Comment