Image Source: Zacks Investment ResearchFurthermore, Alexander’s stock trades at a reasonable 16.6X forward earnings multiple and offers a 7.93% annual dividend yield that towers over the S&P 500’s 1.27% average and trumps many of its Zacks Real Estate Market peers.

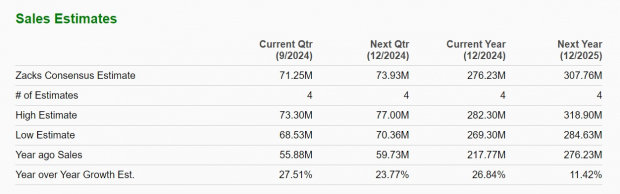

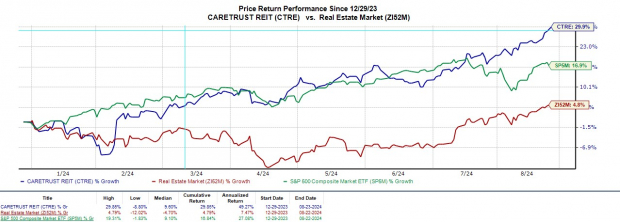

Image Source: Zacks Investment ResearchCareTrust (CTRE – Free Report)Operating healthcare-related facilities, CareTrust is a REIT that has seen steady earnings growth despite a tougher inflationary environment. Rate cuts could catapult CareTrust’s probability with annual earnings expected to be up 4% in FY24 and slated to rise another 10% in FY25 to $1.62 per share.CareTrust’s rapid top line expansion also alludes to its future earnings potential with total sales projected to climb 27% this year and expected to expand another 11% in FY25 to $307.76 million. Image Source: Zacks Investment ResearchNotably, CareTrust’s stock has soared +30% year to date but still trades at a reasonable earnings multiple of 19.6X. CareTrust’s 4.02% annual dividend yield also edges many of its real estate peers and the benchmark.

Image Source: Zacks Investment ResearchNotably, CareTrust’s stock has soared +30% year to date but still trades at a reasonable earnings multiple of 19.6X. CareTrust’s 4.02% annual dividend yield also edges many of its real estate peers and the benchmark.

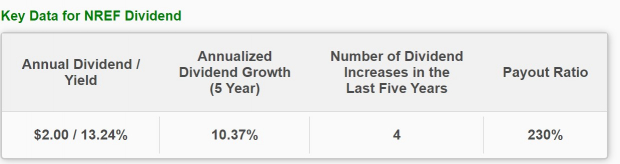

Image Source: Zacks Investment ResearchNexPoint Real Estate Finance (NREF – Free Report)Rounding out the list is NexPoint Real Estate Finance which originates, structures, and invests in first mortgage loans, mezzanine loans, preferred equity, and alternative structured financings in commercial real estate. NexPoint’s massive dividend may certainly catch the attention of income investors with a current yield of 13.24%.

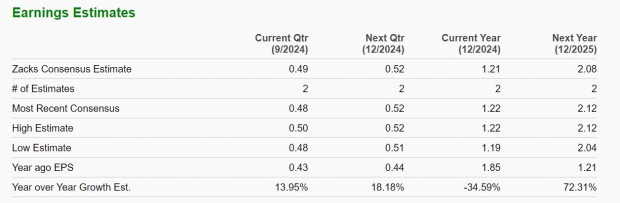

Image Source: Zacks Investment ResearchMore reassuring is that NexPoint trades at 12.4X forward earnings with EPS expected to dip -34% in FY24 but projected to rebound and soar 72% next year to $2.08 per share.

Image Source: Zacks Investment ResearchBottom LineRate cuts would start to propel REITs and Alexander’s, CareTrust, and NexPoint have enticing dividends that attract investors to these equities. With earnings estimate revisions starting to trend higher for these highly ranked REITs, their favorable valuations also indicate now is a good time to buy.More By This Author:Nvidia: The Path To $10 Trillion Bear Of The Day: BowleroNvidia Earnings Preview: Will It Beat Again?

Leave A Comment