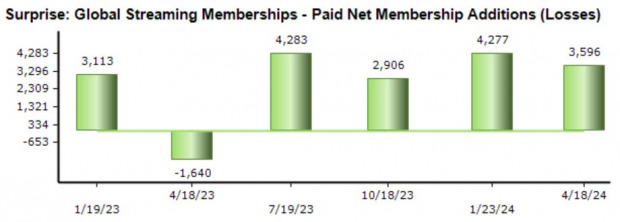

Image Source: Zacks Investment ResearchEarnings and revenue expectations have primarily remained the same, with current estimates alluding to 43% EPS growth on 17% higher sales. The company’s profitability has improved nicely amid operational efficiencies, with margins moving higher over the last few periods.Please note that the chart below is on a trailing twelve-month basis.

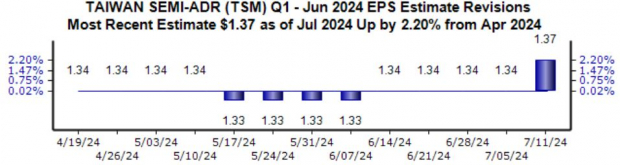

Image Source: Zacks Investment ResearchEarnings and revenue expectations have primarily remained the same, with current estimates alluding to 43% EPS growth on 17% higher sales. The company’s profitability has improved nicely amid operational efficiencies, with margins moving higher over the last few periods.Please note that the chart below is on a trailing twelve-month basis. Image Source: Zacks Investment ResearchTaiwan SemiconductorTSM shares have benefited nicely on the back of the broader semiconductor trade in 2024, gaining more than 80% and widely outperforming. The AI frenzy has been the primary driver behind the semiconductor trade, with companies racing to arm themselves with AI chips.Earnings expectations for the quarter stayed stagnant for some time but have recently ticked higher, with the $1.37 per share estimate suggesting a 20% climb from the year-ago period. Sales expectations have been more positive, with the $20.2 billion expected up 5% over the same timeframe and alluding to a 29% climb year-over-year.

Image Source: Zacks Investment ResearchTaiwan SemiconductorTSM shares have benefited nicely on the back of the broader semiconductor trade in 2024, gaining more than 80% and widely outperforming. The AI frenzy has been the primary driver behind the semiconductor trade, with companies racing to arm themselves with AI chips.Earnings expectations for the quarter stayed stagnant for some time but have recently ticked higher, with the $1.37 per share estimate suggesting a 20% climb from the year-ago period. Sales expectations have been more positive, with the $20.2 billion expected up 5% over the same timeframe and alluding to a 29% climb year-over-year. Image Source: Zacks Investment ResearchIt’s worth noting that valuation multiples have expanded amid investors’ expectations of higher growth, with the current 26.5X forward 12-month earnings multiple above the 19.8X five-year median. Still, the current PEG ratio works out to 1.1X, reflecting that investors aren’t overpaying for growth.

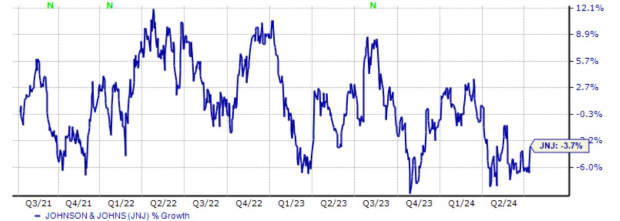

Image Source: Zacks Investment ResearchIt’s worth noting that valuation multiples have expanded amid investors’ expectations of higher growth, with the current 26.5X forward 12-month earnings multiple above the 19.8X five-year median. Still, the current PEG ratio works out to 1.1X, reflecting that investors aren’t overpaying for growth. Image Source: Zacks Investment ResearchKeep in mind that TSM announced a 10% boost to its payout following the release of its latest results, bringing the quarterly total to $0.45/share. TSM’s commitment to increasingly rewarding shareholders has kept it a favorite among income-focused investors seeking technology and semiconductor exposure.TSM reports on Thursday, July 18, after the market’s close.Johnson & JohnsonConsumer staples favorite Johnson & Johnson hasn’t seen its shares do much over the last three years, trading sideways and overall losing 4%. Nonetheless, the company has continued to be a strong earnings performer, exceeding our consensus EPS estimate in ten consecutive releases.

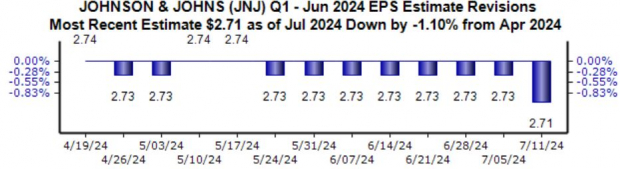

Image Source: Zacks Investment ResearchKeep in mind that TSM announced a 10% boost to its payout following the release of its latest results, bringing the quarterly total to $0.45/share. TSM’s commitment to increasingly rewarding shareholders has kept it a favorite among income-focused investors seeking technology and semiconductor exposure.TSM reports on Thursday, July 18, after the market’s close.Johnson & JohnsonConsumer staples favorite Johnson & Johnson hasn’t seen its shares do much over the last three years, trading sideways and overall losing 4%. Nonetheless, the company has continued to be a strong earnings performer, exceeding our consensus EPS estimate in ten consecutive releases. Image Source: Zacks Investment ResearchThe earnings estimate revisions trend has been slightly bearish for the upcoming release, with the $2.71 Zacks Consensus EPS estimate down 1% since mid-April. As shown below, the estimate was lowered near the beginning of this July.Revenue expectations have remained the same over the same period, with the $22.4 billion expected suggesting a 12% pullback year-over-year.

Image Source: Zacks Investment ResearchThe earnings estimate revisions trend has been slightly bearish for the upcoming release, with the $2.71 Zacks Consensus EPS estimate down 1% since mid-April. As shown below, the estimate was lowered near the beginning of this July.Revenue expectations have remained the same over the same period, with the $22.4 billion expected suggesting a 12% pullback year-over-year. Image Source: Zacks Investment ResearchJNJ reports on Wednesday, July 17, before the market opens.Bottom LineWith the 2024 Q2 earnings season kicking into a much higher gear next week, there are several reports investors should keep on their radars, including those from Netflix, Taiwan Semiconductor, and Johnson & Johnson.More By This Author:Small Caps Roar: 3 Stocks To Ride The Momentum

Image Source: Zacks Investment ResearchJNJ reports on Wednesday, July 17, before the market opens.Bottom LineWith the 2024 Q2 earnings season kicking into a much higher gear next week, there are several reports investors should keep on their radars, including those from Netflix, Taiwan Semiconductor, and Johnson & Johnson.More By This Author:Small Caps Roar: 3 Stocks To Ride The Momentum

3 Companies Set To Positively Surprise This Earnings Season

These 3 Non-Tech Stocks Have Delivered Outsized Gains

Leave A Comment