At this stage of the game, the majority of S&P 500 companies have reported earnings. So it’s a pretty good time in which to analyze this earnings season. I am going to rely on theam going to rely on the in-depth analysis done by my good friend Sheraz Mian, Director of Research at Zacks and a TalkMarkets Contributor. He is one of the top commentators on earnings trends…so it’s always worth getting his insights.

Nutshell Statement: “…this will still represent a favorable corporate earnings backdrop for stocks.”

3 Key Insights:

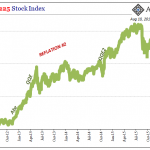

This robust growth this year is mostly because of the recent corporate tax changes in the US. That will cool down to a more realistic 8-10% pace next year. Even still, when you see the PE on the overall market, that is actually quite modest at this stage of a nine year bull market. Meaning that from both an earnings growth and valuation standpoint there is more upside potential for stocks.And as noted in the first bullet above, the energy group is seeing some of the strongest growth, which is why I share this stock with you below.

Leave A Comment