Image: BigstockWe’re in the thick of earnings season, which is undoubtedly an exciting time for investors. We have many companies unveiling quarterly results daily, providing shareholders with a snapshot of what’s transpired behind closed doors.Of course, big tech dominated the reporting docket this week. But next week, there are several notable companies slated to report as well, including Caterpillar (CAT – Free Report), Advanced Micro Devices (AMD – Free Report), and PayPal (PYPL – Free Report).But what can investors expect next week? Let’s take a closer look at estimates heading into the releases.

Image: BigstockWe’re in the thick of earnings season, which is undoubtedly an exciting time for investors. We have many companies unveiling quarterly results daily, providing shareholders with a snapshot of what’s transpired behind closed doors.Of course, big tech dominated the reporting docket this week. But next week, there are several notable companies slated to report as well, including Caterpillar (CAT – Free Report), Advanced Micro Devices (AMD – Free Report), and PayPal (PYPL – Free Report).But what can investors expect next week? Let’s take a closer look at estimates heading into the releases.

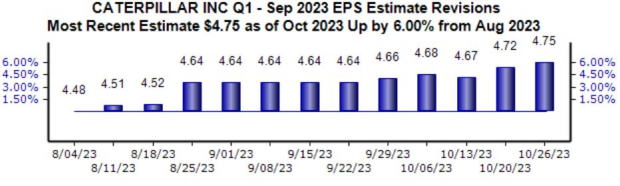

Caterpillar

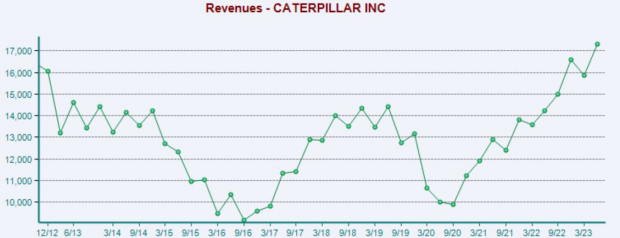

Analysts have been bullish for CAT’s quarter to be reported, with the $4.75 Zacks Consensus EPS Estimate up 6% since August alone. The value reflects a sizable 20% jump from the year-ago period. Top line revisions have also been positive, as the $16.6 billion quarterly revenue estimate has moved 2% higher during the same period. Image Source: Zacks Investment ResearchIt’s worth noting that the company has posted results well above expectations in back-to-back releases, penciling in bottom line beats of 23% and 29% relative to the Zacks Consensus EPS Estimate. Top line performance has also remained positive, with CAT exceeding sales expectations in four consecutive quarterly releases.As we can see in the chart below, revenues have eclipsed pre-pandemic levels.

Image Source: Zacks Investment ResearchIt’s worth noting that the company has posted results well above expectations in back-to-back releases, penciling in bottom line beats of 23% and 29% relative to the Zacks Consensus EPS Estimate. Top line performance has also remained positive, with CAT exceeding sales expectations in four consecutive quarterly releases.As we can see in the chart below, revenues have eclipsed pre-pandemic levels. Image Source: Zacks Investment ResearchIn addition, CAT shares aren’t expensive on a relative basis, with the current 12.2X forward earnings multiple (F1) well beneath the 15.8X five-year median and highs of 21.4X in 2022. The stock sports a Style Score of “B” for Value.

Image Source: Zacks Investment ResearchIn addition, CAT shares aren’t expensive on a relative basis, with the current 12.2X forward earnings multiple (F1) well beneath the 15.8X five-year median and highs of 21.4X in 2022. The stock sports a Style Score of “B” for Value. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

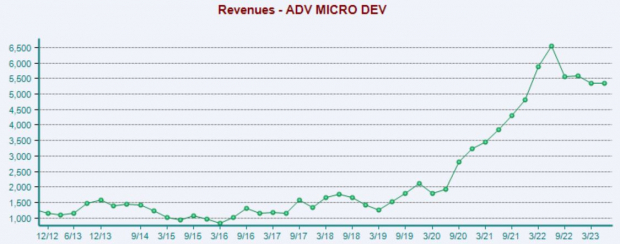

Advanced Micro Devices

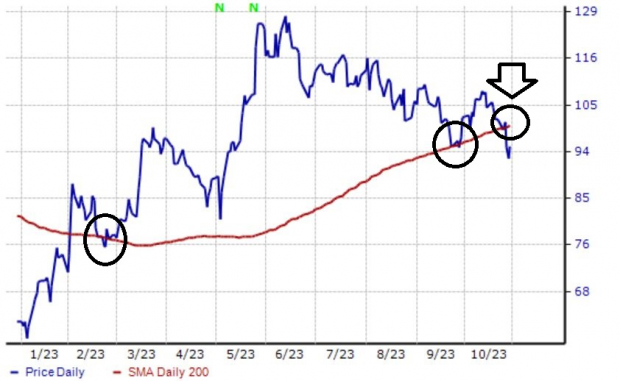

Analysts have kept quiet for the upcoming release, with the $0.68 Zacks Consensus EPS Estimate unchanged since August, reflecting a modest 1.5% climb year-over-year.Top line revisions primarily paint the same story, as the $5.7 billion quarterly revenue estimate is up a fractional 0.1% during the same period and reflects year-over-year growth of 2.5%. Below is a chart illustrating the company’s revenue on a quarterly basis. Image Source: Zacks Investment ResearchAMD shares faced selling pressure post-earnings following its latest release, breaking a streak of back-to-back positive reactions and likely reflecting profit-taking after a strong year-to-date run. Since the print, AMD shares have continued to slide.In addition, shares recently broke through their 200-day daily moving average, a significant level that previously provided support. It looks worthwhile for investors to wait until shares can clear and reclaim this key level.

Image Source: Zacks Investment ResearchAMD shares faced selling pressure post-earnings following its latest release, breaking a streak of back-to-back positive reactions and likely reflecting profit-taking after a strong year-to-date run. Since the print, AMD shares have continued to slide.In addition, shares recently broke through their 200-day daily moving average, a significant level that previously provided support. It looks worthwhile for investors to wait until shares can clear and reclaim this key level. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

PayPal

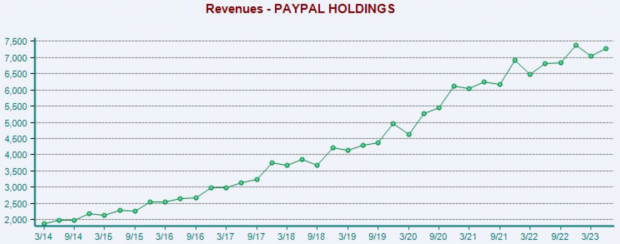

PayPal shares have faced adverse price action all throughout 2023, with the company’s quarterly results regularly sparking negative reactions in the market. Image Source: Zacks Investment ResearchStill, the company is forecasted to post solid growth, with Zacks Consensus EPS and Sales Estimates suggesting year-over-year growth rates of 13% and 8%, respectively. The quarterly estimates have primarily remained stagnant since August.In addition, PayPal’s top line growth has remained highly favorable. As illustrated below, the company’s top line consistency hasn’t translated over to share performance, likely reflecting investors’ sentiment of rising competition within the digital payments space.

Image Source: Zacks Investment ResearchStill, the company is forecasted to post solid growth, with Zacks Consensus EPS and Sales Estimates suggesting year-over-year growth rates of 13% and 8%, respectively. The quarterly estimates have primarily remained stagnant since August.In addition, PayPal’s top line growth has remained highly favorable. As illustrated below, the company’s top line consistency hasn’t translated over to share performance, likely reflecting investors’ sentiment of rising competition within the digital payments space. Image Source: Zacks Investment ResearchTotal Payment Volume (TPV) is a key metric for PayPal, providing us with a clearer picture regarding demand for the company’s platform. For the quarter, the Zacks Consensus Estimate for TPV stands at $381.8 billion, 13% higher than the year-ago figure. PayPal has exceeded our consensus TPV expectations in back-to-back releases.

Image Source: Zacks Investment ResearchTotal Payment Volume (TPV) is a key metric for PayPal, providing us with a clearer picture regarding demand for the company’s platform. For the quarter, the Zacks Consensus Estimate for TPV stands at $381.8 billion, 13% higher than the year-ago figure. PayPal has exceeded our consensus TPV expectations in back-to-back releases.

Bottom Line

Earnings season will continue picking up steam, with a wide variety of companies slated to reveal quarterly results in the coming weeks.And next week, three notable releases to keep an eye out for include PayPal (PYPL – Free Report), Caterpillar (CAT – Free Report), and Advanced Micro Devices (AMD – Free Report).More By This Author:These 3 Top-Ranked Companies Boast Robust Sales GrowthRoku Gears Up To Report Q3 Earnings: What’s In The Cards? Bull Of The Day: Applied Industrial Technologies

Leave A Comment