Tencent (OTCPK: TCEHY) stock is under heavy selling pressure, falling by more than 25% from its highs of the year due to macroeconomic uncertainty in China and lower than expected earnings from the company last quarter.

However, recent weakness in financial performance is mostly temporary as opposed to permanent. The big picture in Tencent stock remains intact from a long-term perspective, and current valuation levels are clearly attractive.

1. Underlying Performance Remains Strong

Tencent delivered lower-than-expected revenue and a decline in net profit during the second quarter of 2018. However, this was only due to weakness in the online games segment, since Chinese regulatory authorities have suspended the approval of new online games because of an ongoing restructure of the administrations governing this space.

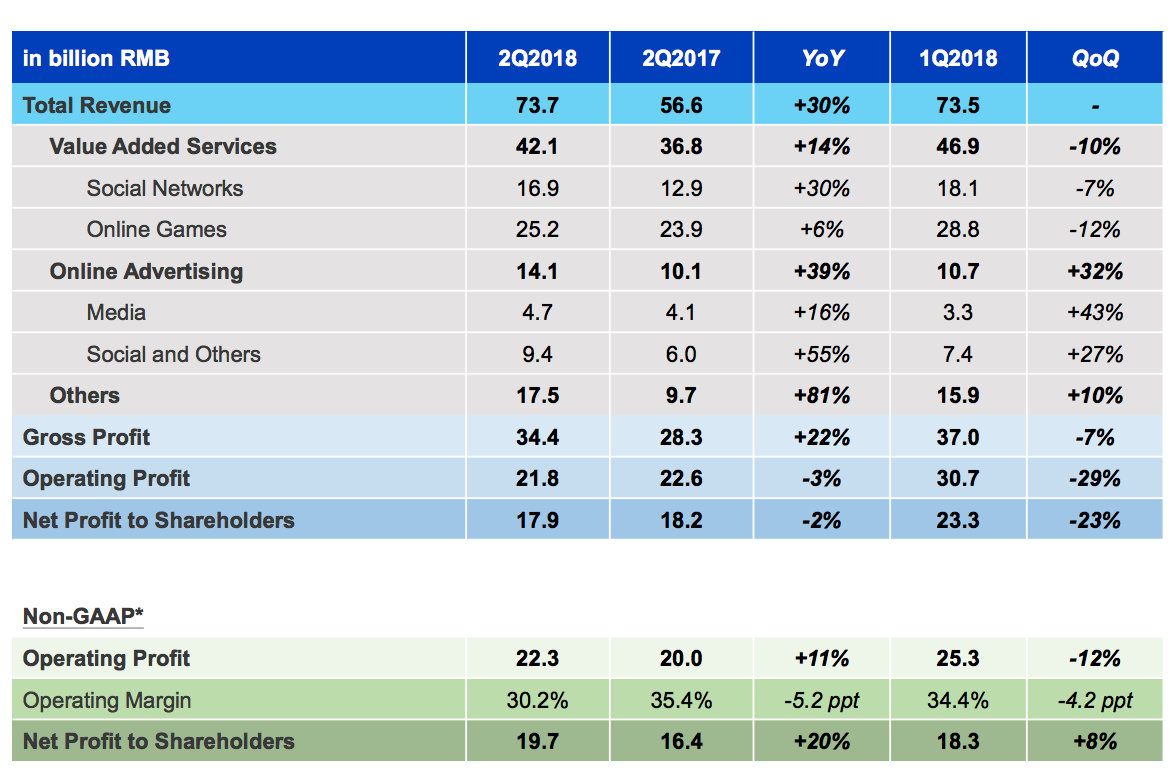

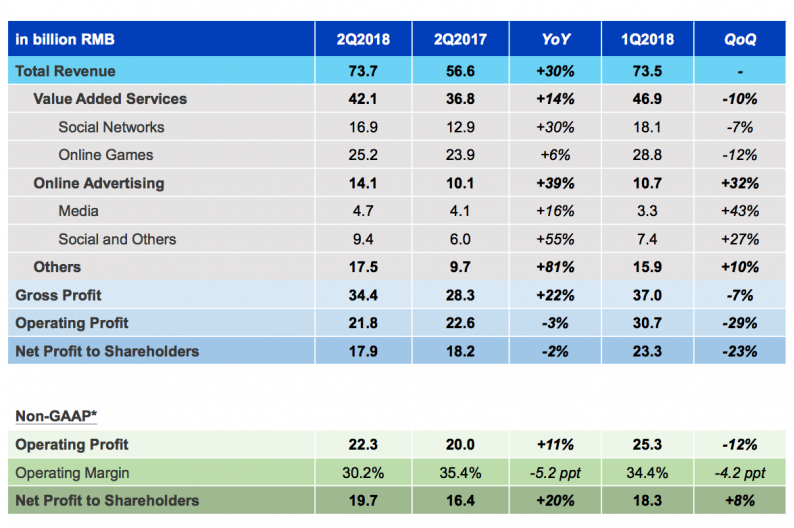

Source: Tencent

Total company revenue increased by a vigorous 30% year over year, with online advertising growing 39% on the back of an explosive increase of 55% in social media advertising.

This is in spite of the fact that Tencent is barely starting to monetize WeChat. The company is only showing users two ads per day in its WeChat Moments feed. Tencent has enormous room to increasingly monetize WeChat going forward, and this opportunity will probably be a remarkably powerful growth engine in the years ahead.

The company also is growing at full speed in areas such as digital payments, cloud computing, and online video. These smaller businesses currently have thinner margins than online games, but profitability is set to expand as these younger platforms gain size and scale over time.

Even if the approval process for new online games in the coming months remains uncertain, Tencent has a pipeline of 15 games already approved for launch. Besides, the company is increasingly diversifying its revenue base over the past several years. Online games are declining as a share of total revenue, from 48% in the second quarter of 2016 to 42% in the second quarter of 2017, and to 34% of revenue in the second quarter of 2018.

Leave A Comment