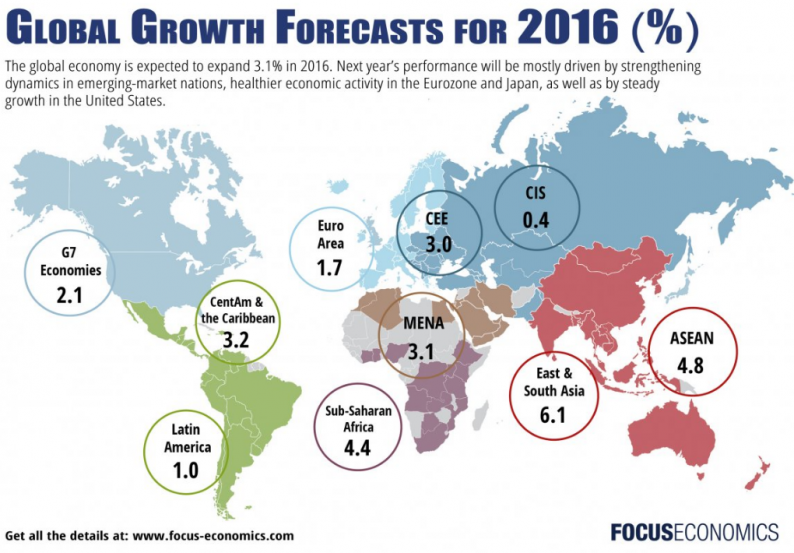

I have spent a lot of time since returning from speaking at the Money Show out at Las Vegas earlier in the month catching up on my reading. Unfortunately, not much that I have reviewed points to much strength in the domestic economy and worldwide activity remains at its lowest levels since 2009. Global demand looks like it will be anemic at least through year-end.

While the United States remains the best house in a bad neighborhood, it is still a fixer-upper home at the moment. We have a contentious presidential election coming up with two candidates that already have the highest unfavorable rating measures in the modern era; these numbers come in before either candidate has spent billions on attack ads. Murder rates just had their biggest percentage annual advance in major cities since at least 1960 and the economy has not grown at historical trend levels in some 15 years now. In short, there is a lot of angst, anger, and anxiety in the general population right now and with good reason.

From an economic view, there are myriad items to be concerned about right now. We continue to be in the weakest post-war recovery on record despite adding some $8 trillion to the national debt since the financial crisis. This historically weak rebound has also occurred despite the Federal Reserve quintupling its balance sheet and keeping interest rates near zero for almost a decade now.

It is not only the massive debt at the federal level that should have investors worried on a long-term basis, it is the debt levels both on the personal and corporate sides of the ledger. The huge burden that over $1 trillion in student loans has put on the young has been in the headlines this year leading into the election; although, not as much has been said about the massive default rates in that area of credit. The average graduate who has taken on student loans graduates with between $25,000 and $30,000 in total debt these days.

However, student loans are not the only debt weighing the consumer down. U.S. credit-card balances are set to crack the one-trillion-dollar mark by the end of the year. This would be right near the record $1.02 trillion for credit-card loans registered in July 2008 just before the implosion at Lehman threw the nation into the financial crisis. Total auto loan debt in the U.S. has now reached $1.1 trillion, up 30% from its pre-recession peak. In addition, a significant share of those auto loans are being made to people with lower credit scores who are much more likely to default should the economy downshift into a recession at some point on the horizon. Ironically, car payments tend to be 45% to 75% higher than the average student debt payment and yet we are seeing much less focus here by politicians as a potential problem point.

Leave A Comment