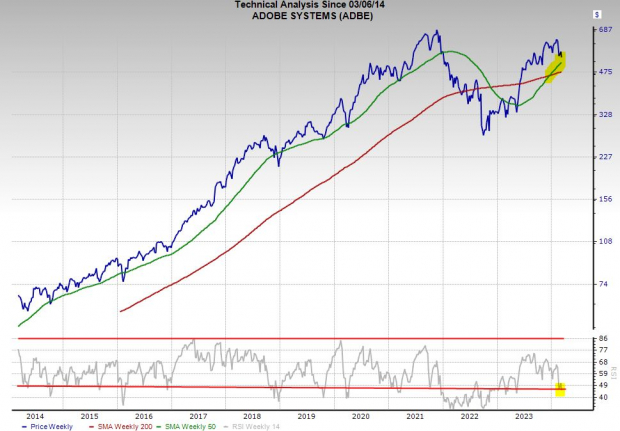

The bulls dug their heels in at the Nasdaq’s 21-day moving average midweek and the buying continued through morning trading Thursday. The rhythm of the march to start 2024 has prevented stocks from severely overheating, as the market experiences mini pullbacks every few weeks.The tech bubble talk and AI exuberance clouded the fact that some tech stocks have taken a beating recently while others are yet to recover from their 2022 downturns. Investors might want to be greedy while others are fearful and buy impressive tech stocks at a discount while Nvidia and others reach overbought levels in the short-term.Adobe (ADBE)Adobe trades roughly 20% below its all-time highs heading into its Q1 FY24 earnings release on March 14. Wall Street is worried about its slowing top-line growth and how it will compete as companies such as OpenAI enable users to generate creative content with almost no skills. Investors are also disappointed that Adobe had to scrap its planned Figma acquisition over regulatory headwinds.ADBE’s revenue expansion cooled over the last two years following a stretch of 15% to 25% expansion. Still, the creative software giant posted 10% and 12% sales growth the last two years and Adobe’s revenue is projected to climb 10% in FY24 and 12% higher in FY25 to reach $23.91 billion.ADBE’s adjusted EPS are projected to jump by 11% and 13%, respectively and its positive revisions help it land Zacks Rank #2 (Buy).  Image Source: Zacks Investment ResearchAdobe’s industry-leading creative software is still used by Hollywood movie studios, best-selling artists, college students, companies, and more. Adobe is also rolling out AI features across its portfolio.ADBE has slipped -2% in the last six months vs. the Zacks Tech sector’s +20% run. ADBE is down 15% since early February and 20% from its 2021 highs. ADBE trades below its 200-day moving average and near oversold RSI levels. But it remains above its long-term 50-week moving average. On the value side, Adobe trades 60% below its 10-year highs and at a 7% discount to its median at 36.4X forward earnings.

Image Source: Zacks Investment ResearchAdobe’s industry-leading creative software is still used by Hollywood movie studios, best-selling artists, college students, companies, and more. Adobe is also rolling out AI features across its portfolio.ADBE has slipped -2% in the last six months vs. the Zacks Tech sector’s +20% run. ADBE is down 15% since early February and 20% from its 2021 highs. ADBE trades below its 200-day moving average and near oversold RSI levels. But it remains above its long-term 50-week moving average. On the value side, Adobe trades 60% below its 10-year highs and at a 7% discount to its median at 36.4X forward earnings.

Apple (AAPL)

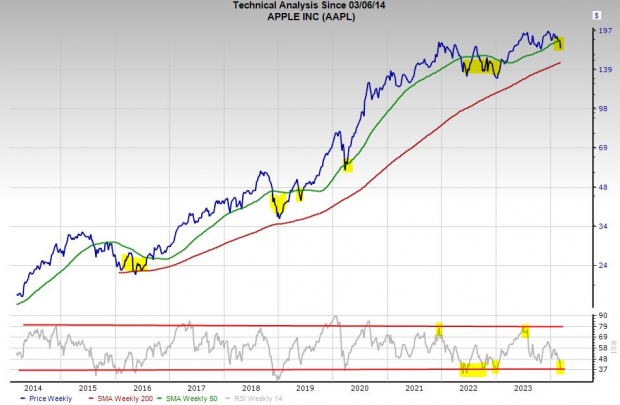

Apple stock has fallen 12% YTD vs. Tech’s 9% climb and Nvidia’s (NVDA) 85% surge to trade 15% below its mid-December records. Wall Street is worried about slowing growth in China and increased geopolitical conflict in the world’s second-largest economy. Investors also fear Apple is falling behind on AI.Fears about slowing expansion in China are valid. On the other hand, it will no doubt be able to introduce AI features at some point soon. AAPL sales declined 2.8% in FY23 revenue (its third YoY decline during the last eight years). Apple is projected to post 1% growth in FY24 and 5% higher sales in FY25 to boost its adjusted earnings by 7% and 9%, respectively.  Image Source: Zacks Investment ResearchCEO Tim Cook has transformed Apple beyond an iPhone maker. The firm’s active devices surpassed 2.2 billion, with well over 1 billion paid subscriptions (double four years ago). AAPL’s services efforts include the App Store, Netflix and Spotify competitors, Apple Wallet, a video game platform, and more. On top of that, its Vision Pro devices are catching on at the enterprise level.Apple closed last quarter with $65 billion in net cash and plans to keep buying back stock and paying dividends as it attempts to become net cash neutral. Apple stock climbed by roughly 800% in the last 10 years to blow away the Zacks Tech sector’s 290% run. Yet, Apple is only up 45% in the past three years and it has underperformed tech in the last 12 months, up 11% vs. 48%.Apple trades below its 50-week moving average, which is a level it has rarely stayed below for too long over the last decade. AAPL is also trading at oversold RSI levels. Valuation-wise, Apple trades at a 25% discount to its 10-year highs at 24.9X forward 12-month earnings vs. Tech’s 26.2X.

Image Source: Zacks Investment ResearchCEO Tim Cook has transformed Apple beyond an iPhone maker. The firm’s active devices surpassed 2.2 billion, with well over 1 billion paid subscriptions (double four years ago). AAPL’s services efforts include the App Store, Netflix and Spotify competitors, Apple Wallet, a video game platform, and more. On top of that, its Vision Pro devices are catching on at the enterprise level.Apple closed last quarter with $65 billion in net cash and plans to keep buying back stock and paying dividends as it attempts to become net cash neutral. Apple stock climbed by roughly 800% in the last 10 years to blow away the Zacks Tech sector’s 290% run. Yet, Apple is only up 45% in the past three years and it has underperformed tech in the last 12 months, up 11% vs. 48%.Apple trades below its 50-week moving average, which is a level it has rarely stayed below for too long over the last decade. AAPL is also trading at oversold RSI levels. Valuation-wise, Apple trades at a 25% discount to its 10-year highs at 24.9X forward 12-month earnings vs. Tech’s 26.2X.

Block Inc. (SQ)

Block, formally known as Square, trades over 70% below its peaks. SQ moved sideways over the last 12 months vs. Tech’s 48% and trades at early 2020 levels before its Covid bust and massive boom. Wall Street dumped the former tech star because of rising interest rates, slowing consumer spending, tough-to-compete against periods, increased competition, and an ill-timed acquisition. Block appeared to greatly overpay for buy now pay later firm Afterpay at the height of tech valuations. Block is also a victim of its overnight Covid-induced boom. Its sales soared 86% in 2021 and 102% in 2020, climbing from $4.7 billion in FY19 to $17.66 billion in 2021 vs. its pre-Covid pace of around 40%.  Image Source: Zacks Investment ResearchBlock remains a futuristic digital banking and financial services firm for consumers and businesses. Block posted 25% revenue growth in 2023 after its sales were roughly flat in 2022. The firm is projected to post 13% revenue expansion in FY24 and 12% higher in 2025. Meanwhile, its adjusted earnings are projected to soar 64% this year and 31% next year.Block’s positive EPS revisions help it land a Zacks Rank #1 (Strong Buy) right now, and 29 of the 40 brokerage recommendations Zacks has are “Strong Buys,” next to only one “Strong Sell.” SQ is back above its 50-day moving average.The stock’s PEG ratio, which factors in its long-term growth outlook, is at 2.2 vs. Tech’s 1.9 and its one-year highs of over 200. Block trades at a 60% discount to Tech at 1.9X forward 12-month sales and 84% below its highs. More By This Author:2 Leading Tech Stocks To Buy In March And Hold: TSM And NFLX

Image Source: Zacks Investment ResearchBlock remains a futuristic digital banking and financial services firm for consumers and businesses. Block posted 25% revenue growth in 2023 after its sales were roughly flat in 2022. The firm is projected to post 13% revenue expansion in FY24 and 12% higher in 2025. Meanwhile, its adjusted earnings are projected to soar 64% this year and 31% next year.Block’s positive EPS revisions help it land a Zacks Rank #1 (Strong Buy) right now, and 29 of the 40 brokerage recommendations Zacks has are “Strong Buys,” next to only one “Strong Sell.” SQ is back above its 50-day moving average.The stock’s PEG ratio, which factors in its long-term growth outlook, is at 2.2 vs. Tech’s 1.9 and its one-year highs of over 200. Block trades at a 60% discount to Tech at 1.9X forward 12-month sales and 84% below its highs. More By This Author:2 Leading Tech Stocks To Buy In March And Hold: TSM And NFLX

Is Salesforce Stock A Buy Ahead Of Q4 Earnings As Tech Stocks Soar?

3 Large-Cap Stocks To Buy Now And Hold Through Thick And Thin

Leave A Comment