With more than 45 million self-directed investors, many online brokers and other wealth tech providers are struggling with user acquisition. The cost of acquiring a new user can vary from $250 – $1500 which is why companies allocate considerable resources to retain existing users.

Market intelligence fintech and new alternative brokerages are on the rise, and the number of investors subscribing to their services shows demand for new research and innovative UI is growing too. Brokers that wish to stay relevant and retain users need to develop solutions such as improving user experience and/or creating online communities. This can mean better research tools, easier navigation, and high quality educational tools and content.

In light of this, TipRanks has compiled a list of the 3 most popular research tools based on a poll sent to 100,000 traditional/ active investors and active traders.

1. Expert Opinions

An eMarketer research published in 2014 shows that 72% of millennial investors prefer to make their own investment decisions with about half saying they will consult with experts. Experts can be analysts, high profile advisers, or “Gurus” such as prominent hedge fund managers. With growing reliance on external sources of experts for the last five years, more and more brokers offer research tools around financial experts to help investors gain confidence and make better-informed decisions. Over the last three years, most of the leading online brokers have offered some sort of “Expert center”. TipRanks leads this category with a fast-growing “Expert center” which is provided to 50 online brokers worldwide. Fidelity also partnered with Thomson Reuters to provide analyst recommendations, and most of the online brokers found other alternatives.

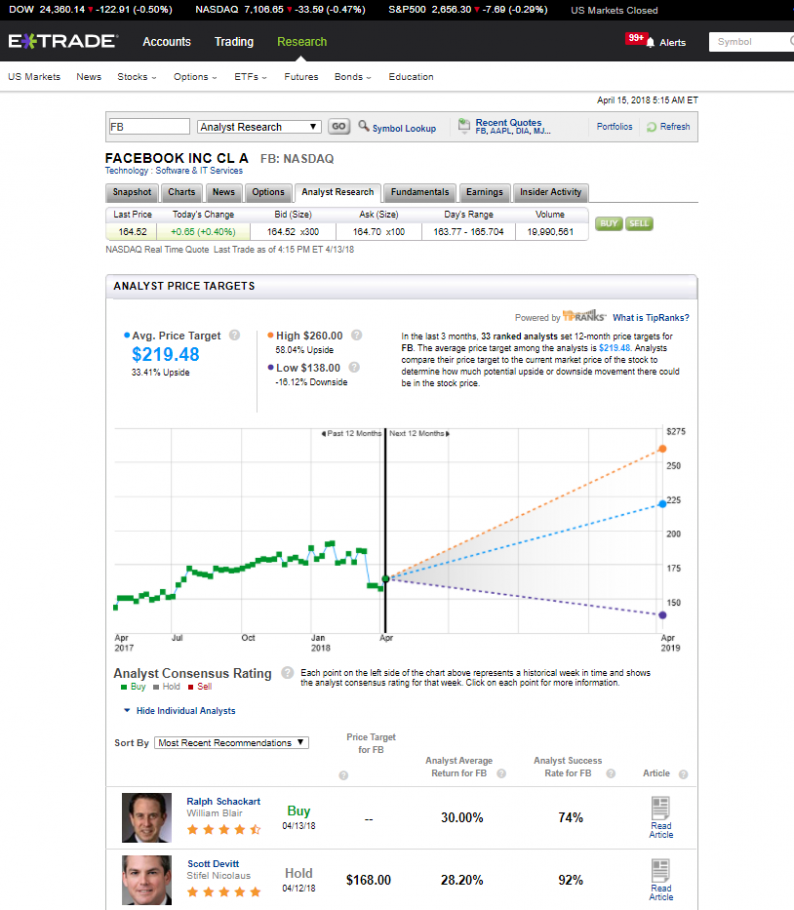

E*TRADE Stock Analyst Recommendations by TipRanks

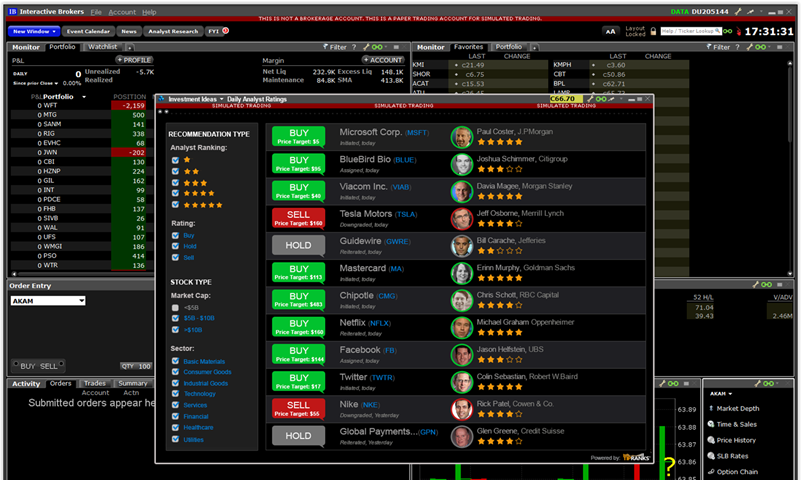

Interactive Brokers – Daily Analyst Ratings Feed by TipRanks

2. Crowd Wisdom

New social trading platforms are an increasingly popular research method for retail investors. These platforms enable investors to follow the trades of other investors based on their performance. eToro is the undisputed category leader in this space followed by Ayondo, Tradeo and a long list of other brokers. While the concept of copying other people’s trades was not allowed in the US, in other countries this method has really taken off. Over the last year we saw the concept of crowd wisdom popping up with brokers such as Robinhood providing their users Crowd-Wisdom insights based on the activity of their investors.

Leave A Comment