Image Source: Federal Reserve Economic DataAmerican Electric Power (AEP – Free Report)We’ll start with American Electric Power which is one of the largest integrated utility providers in the US. AEP provides electricity, natural gas, and other commodities to over 5.6 million customers.Along with its steady top and bottom line growth, AEP offers a 3.48% annual dividend yield and trades at a reasonable 18.1X forward earning multiple.

Image Source: Zacks Investment ResearchEvergy (EVRG – Free Report) Operating on a smaller scale, Evergy is still worthy of investors’ consideration as the largest electricity provider in Kansas and Missouri with more than 1.7 million customers.Evergy’s increased probability is intriguing as earnings per share is expected to spike 8% this year with fiscal 2025 EPS projected to increase another 5% to $4.04. Plus, EVRG stands out in terms of valuation at 15.5X forward earnings which is a nice discount to the S&P 500’s 22.9X and slightly beneath the Zacks Utility-Electric Power Industry average of 15.9X.More enticing, Evergy’s 4.3% annual dividend yield impressively tops its industry average of 3.43% and the S&P 500’s 1.28% average.

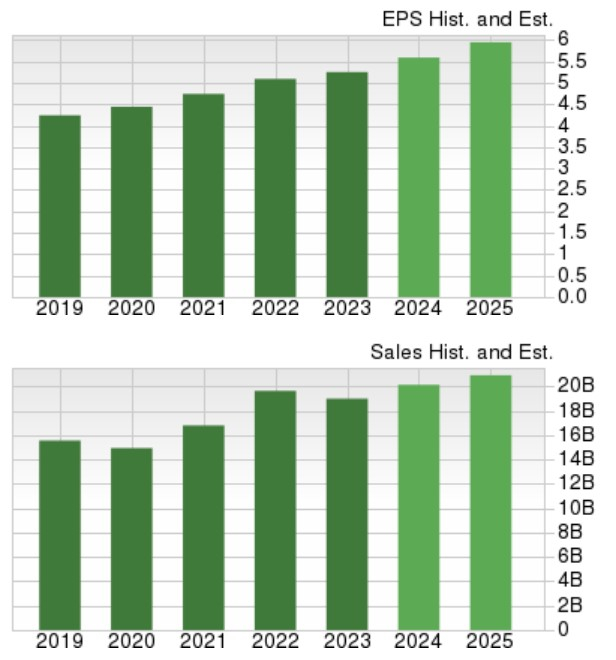

Image Source: Zacks Investment ResearchExelon (EXC – Free Report)Last but not least is Exelon which provides power to over 10 million customers throughout the US with a few of its noteworthy subsidiaries being ComEd and Pepco.Like American Electric Power, Exelon’s robust top line is steadily expanding with sales projections over $20 billion. Furthermore, as a leading utility company, Exelon’s valuation is very reasonable at 15.7X forward earnings with EPS expected to increase 2% in FY24 and projected to rise another 7% next year to $2.61 per share.Exelon also trades at 1.7X sales compared to the Zacks Utility-Electric Power P/S ratio of 2.8X and the S&P 500’s 4.6X. The cherry on top is that Exelon’s dividend is currently at 3.97%.

Image Source: Zacks Investment ResearchBottom LineAt the moment, these utility stocks all sport a Zacks Rank #2 (Buy). With utility stocks generally being less volatile due to their essential services now may be an ideal time to invest in American Electric Power, Evergy, and Exelon given their attractive valuations and generous dividends.More By This Author:3 Standout Stocks Of This Week’s Busy Earnings Lineup Bull of the Day: Badger Meter (BMI)Time To Buy Meta Platforms Stock As Q2 Earnings Approach?

Leave A Comment