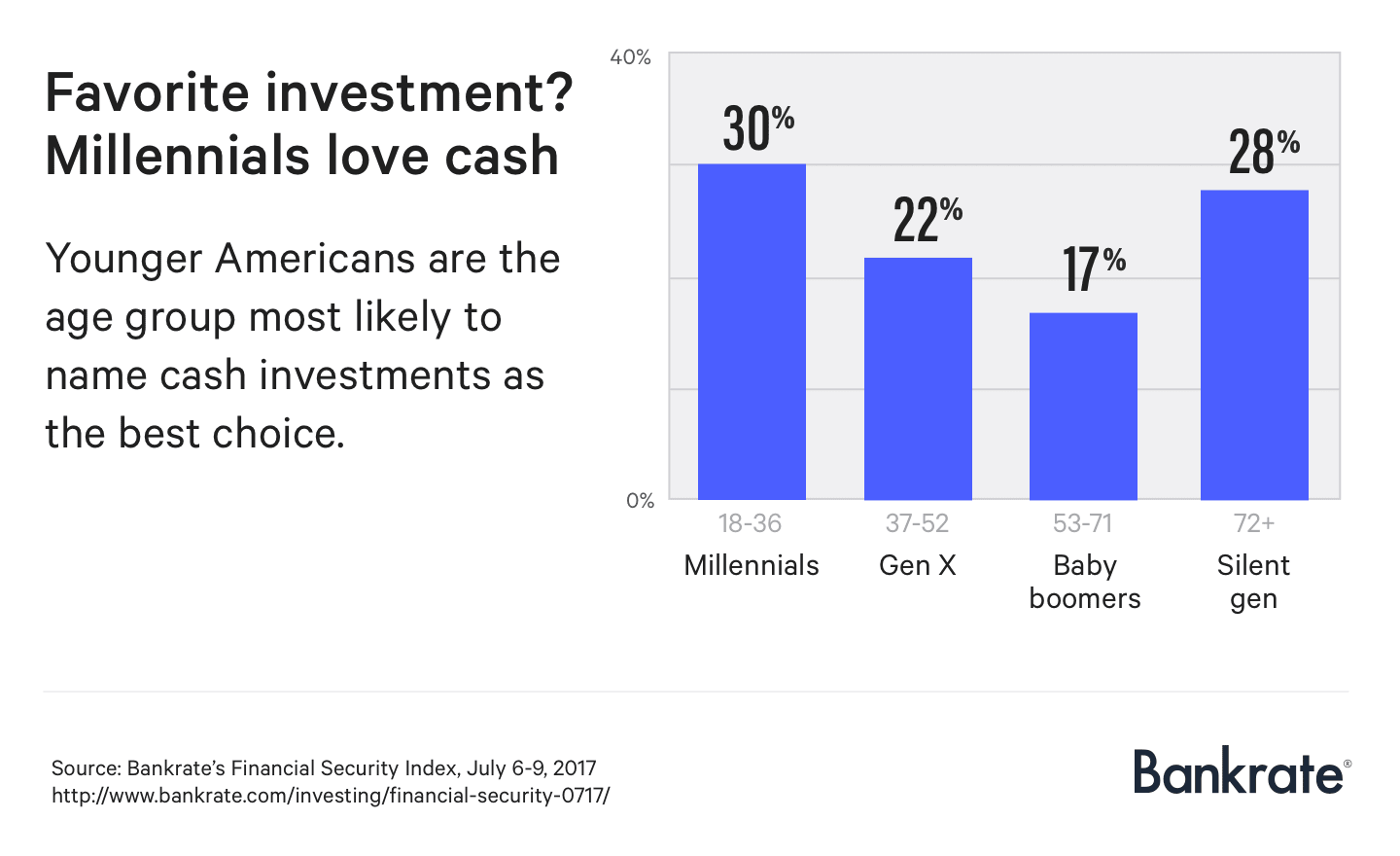

According to a recent study by Bankrate.com, only 13% of millennials said they’d invest in the stock market. Cash is king.

Naturally, this phenomenon has the majority of Wall Street experts besides themselves as stocks seemingly are the only game in town.

Millennials (those born 1977-1995), have so much precious time to weather losses. The cohort is ripe for brainwashing. Wall Street boasts defiantly:

“You need us more than we need you!”

Yet, many in this group shrug and ignore.

Main Street millennials appear to know something Wall Street professionals don’t.

I hate to break it to the experts. The skepticism is spreading.

Generation Z (born in mid-90s to mid-2000s), isn’t enamored with the stale story that stocks only grow to the sky.

I know. I regularly partner with and coach this demographic cohort including my own daughter.

The majority are indeed risk averse; perhaps even more so than millennials.

Obviously, there are a myriad of motivations for this aversion to stocks – lack of knowledge, student loan over indebtedness, a touch of Great Recession mindset as ground-level witnesses to household economic collapse, personal financial fragility, and let’s not forget: outright distrust (which I believe to a degree, is a formidable concern).

Now, for someone like me who has been a student of the market and individual stocks since age 16, I am disheartened by these studies. I still believe the stock market should be a portion of a young adult’s wealth-building plan. It’s just not a panacea as relentlessly touted. If the pros didn’t make stock investing sound so definitely positive and objectively exposed the risks too, perhaps we’d see a healthier stock market participation rate.

My first year in the financial services industry was 1988, in the midst of a great bull market. However, I expected the industry, those who preached stale theories and ostensibly set investor portfolios up for the kill, to change their tunes about allocations and risk after the tech bubble burst in 2000. I had encouraged investors to shift portfolios to more balanced, less aggressive allocations, as early as 1998. Markets cycle data has been out there for what feels like an eternity, yet now more than ever, it’s rarely discussed.

However, the facts are the facts. Markets shift; they’re more than just bull as the public is led to erroneously understand. Although bull markets occur historically with greater frequency, people are surprised to discover that since 1877, bear markets have accounted for 40 percent of market cycles.

Yet, the narrative doesn’t budge. In the media and in front-line closed-door prospect and client meetings at brokerage firms, the stock market fantasy bull is the financial Energizer Bunny. The bullish flipcharts keep flipping; visuals are designed to foster regret if one “misses out,” on the endless bliss of stock returns. Those that outline risk of loss are nowhere to be found.

I believe it to be blatantly irresponsible. Retail big-box investment factories are steadfast “set it and forget it,” peddlers. I’m amazed at their tenacity.

The spiel is rarely altered. Minds never change.

Respected academics do change their minds.

Objective students of market history do.

What has changed is how millennials and generations which follow, are on to the biased rhetoric. Sadly, chronic skepticism and trepidation is hurting younger generations as they should participate in stock investing. They just don’t know who to trust.

Candidly, articles like this – You probably have the wrong idea when it comes to investments. Let’s fix that, don’t fix anything. They showcase the willful arrogance of financial pros and motivates millennials to stay away.

It’s replete with narratives taken out of context like –

“putting your money into safe investments can actually cost you money, if you consider inflation.”

Well, that’s stretching the truth a bit. It depends on the valuations of stocks.

I may assume after reading this piece that stocks always possess less risk than cash, when in fact depending on when they’re purchased, stocks are not the wisest choice. Hoarding excess cash (above that required for emergency reserves and short-term goals that require liquidity), and never seeking to invest in risk assets, I’ll relent is not a smart long-term decision. However, generalizations do nothing to bolster confidence of younger generations. If anything, it turns them off.

Leave A Comment