People Think Their Taxes Will Be Raised, But They Won’t

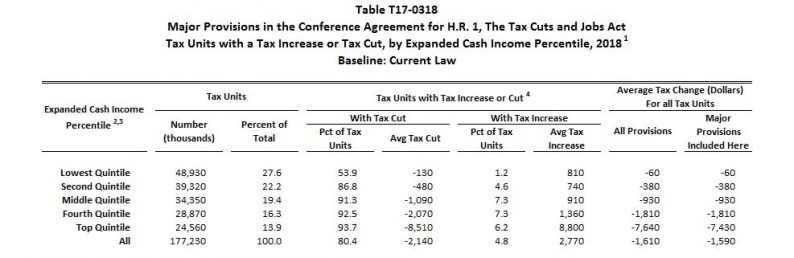

It’s always interesting when vast swaths of people believe something that isn’t true. One example of this is the FOMO involved in cryptocurrencies. The total valuation of all the coins is $606 billion. It’s difficult to rationalize that valuation, but most speculators don’t care. They want to get into a hot market. The latest example of people believing a falsehood is the reverse of that euphoria. Most people are afraid of the tax plan because it has changed many times. I understand why people are uncertain. The media and politicians make so many partisan points about the plan that it’s hard to know who to believe. Whenever you are uncertain about something, it’s easy to believe the worst. I’m not making a partisan point. I’m trying to objectively understand how this tax cut will affect people. According to the Tax Policy Center, 80.4% of Americans will pay less taxes. The Americans which will pay more are the wealthy who live in high tax states like New Jersey. The table below gives an overview of how the tax cuts will affect Americans in each quintile.

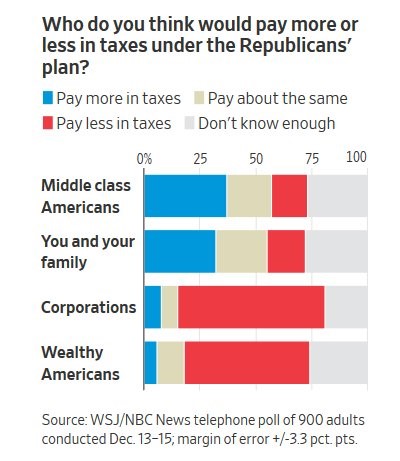

According to a Wall Street Journal poll, 17% of Americans think they will pay less taxes next year. Clearly, 63.4% are wrong about the tax plan if the Tax Policy Center is correct. This is the reverse of what we saw 12 months ago. After President Trump was elected, there was unbridled optimism about the economy even though nothing had changed. I mentioned that the consumer would lose confidence because they’d get impatient. That’s not what happened. Instead, the consumer never got impatient. They’re only becoming more negative lately because of media reports on the new tax plan. There can be a burst in optimism which can boost consumer spending next year when consumers realize the truth about the bill.

In the past two months, the University of Michigan consumer sentiment report showed a decline from 100.7 in October to 96.8 in December. I can see the sentiment polls getting worse in the next couple months now that consumers think a tax increase was passed. Whenever the realization that taxes weren’t raised for most people occurs, I think the pent up demand will be released.

Leave A Comment