Update On Canadian Trade Deal

The trade deal with Canada wasn’t substantially different from the Trans-Pacific Partnership because, under the USMCA, American dairy producers get access to 3.59% of Canada’s dairy market which is only slightly better than the 3.25% they would have gotten from the TPP. The $70 million benefit is the equivalent of 0.0003% of GDP. It’s important to leave the determination of whether it was worth it to enter this trade battle to the political commentators. It’s up to investors to figure out what this means for asset prices.

The deal is much better than not having one which is why the Dow has rallied so much. You should go long the Dow and short the Russell 2000 if you think a deal with China is coming. I don’t see any evidence that the tide will turn towards constructive conversations in the near term. However, the slightest positive detail will bring out animal spirits. Once positive news comes out, it will be difficult to profit off the trade.

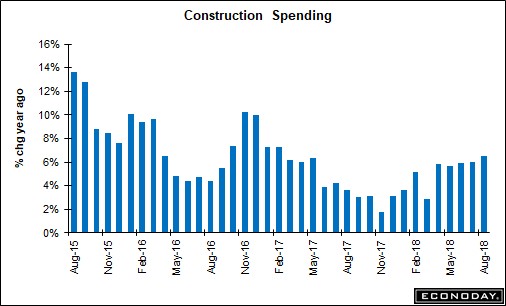

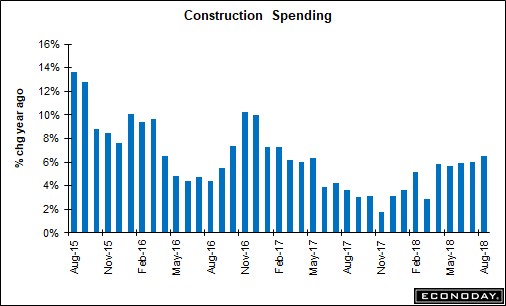

Construction Spending Growth Accelerates

On a month over month basis, August construction spending growth missed expectations, but it accelerated on a year over year basis. It was up 0.1% month over month, missing estimates for 0.4% growth. July’s growth was revised from 0.1% to 0.2%; growth was revised to 6% from 5.8% on a year over year basis. As you can see from the chart below, August growth accelerated to 6.5% on a year over year basis. It was helped by easier comparisons.

Residential construction spending growth decelerated from 0.2% in July to -0.7% in August. Single-family spending fell 0.7%; multi-unit spending fell 1.7%, and home improvement spending fell 0.6%. Government spending drove growth as federal spending growth was 5.9% and state and local growth was 1.7%. Highway and street spending was up 1.7% and education spending was up 1%. Private non-residential spending fell 0.2% because of commercial, power, and manufacturing.

4.1% GDP Growth Expected

Leave A Comment