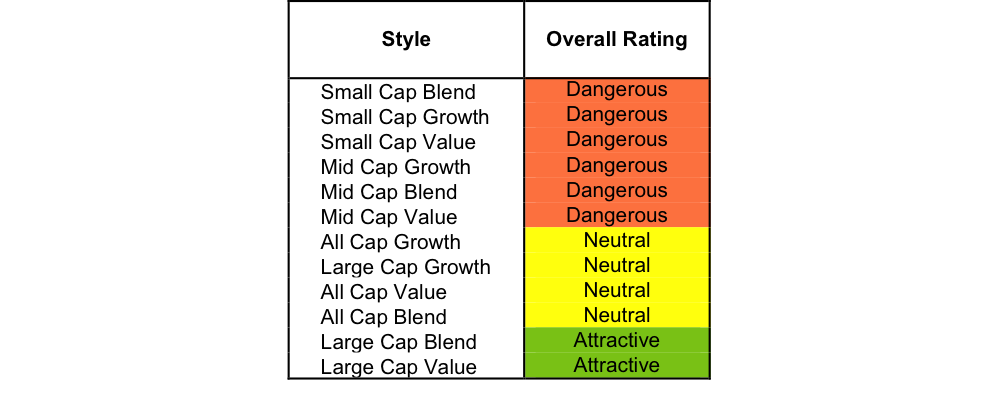

At the beginning of the fourth quarter of 2015, only the Large Cap Value and Large Cap Blend styles earn an Attractive-or-better rating. Our style ratings are based on the aggregation of our fund ratings for every ETF and mutual fund in each style. See last quarter’s Style Ratings here.

Investors looking for style funds that hold quality stocks should look no further than the Large Cap Blend and Large Cap Value styles. Not only do these styles receive our Attractive rating, they also house the most Attractive-or-better rated funds. Figures 4 through 7 provide more details. The primary driver behind an Attractive fund rating is good portfolio management, or good stock picking, with low total annual costs.

Attractive-or-better ratings do not always correlate with Attractive-or-better total annual costs. This fact underscores that (1) cheap funds can dupe investors and (2) investors should invest only in funds with good stocks and low fees.

See Figures 4 through 13 for a detailed breakdown of ratings distributions by investment style. See our ETF & mutual fund screener for rankings, ratings, and reports on 7000+ mutual funds and 400+ ETFs. Our fund rating methodology is detailed here.

All of our reports on the best & worst ETFs and mutual funds in every investment style are available here.

Figure 1: Ratings For All Investment Styles

To earn an Attractive-or-better Predictive Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only the top 30% of all ETFs and mutual funds earn our Attractive or better rating.

State Street SPDR Dow Jones Industrial Average ETF (DIA) is the top rated Large Cap Value fund. It gets our Very Attractive rating by allocating over 51% of its value to Attractive-or-better-rated stocks.

International Business Machines (IBM: $148/share) is one of our favorite stocks held by DIA and receives our Attractive rating. Over the last decade, IBM has grown after-tax profit (NOPAT) by 8% compounded annually while doubling NOPAT margins. In addition to strong NOPAT growth, IBM has improved its return on invested capital (ROIC) to 12%, from 9% in 2005. Despite the strength in its business, IBM shares remain undervalued. At its current price of $148/share, IBM has a price to economic book value ratio (PEBV) of 0.8. This ratio implies that the market expects IBM’s NOPAT to permanently decline by 20%. Even if IBM can only grow NOPAT by 2% compounded annually for the next five years, the stock is worth $211/share today – a 43% upside.

Leave A Comment