In the summer of 1885 William R. Travers, prominent NYC businessman and builder of Saratoga Race Track, was vacationing in Newport, Rhode Island. He pointed out a long line of beautiful yachts tied up in the harbor. When he was informed that they all belonged to Wall Street brokers he simply asked,

“Where are their clients’ yachts?”.

When it comes to investing, there is nothing more dangerous to an individual’s future outcomes than falling prey to the many myths perpetrated on them by Wall Street. The investment business is, after all, just that – a business.

What Wall Street has learned, as the days of commission-based trading have been relegated to computerized trading, is that fee based management is a very profitable annuitized business model. The only trick is keeping individuals fully invested at all times so fees can be collected. This need has generated some of the biggest “myths”in the investment world to keep investors piling money into mutual funds, hedge funds and advisory accounts. Here are 5-myths worth thinking about.

1) Stay Invested – The Market Always Returns 10%

You have heard this one plenty. “Over the long-term” the stock market has generated a 10% annualized total return. So, just plunk your money down and you will be wealthy.

The statement is not entirely false. Since 1900, stock market appreciation plus dividends has provided investors with an AVERAGE return of 10% per year. Historically, 4%, or 40% of the total return, came from dividends alone. The other 60% came from capital appreciation that averaged 6% and equated to the long-term growth rate of the economy.

However, there are several fallacies with the notion that the markets long-term will compound 10% annually.

1) The market does not return 10% every year. There are many years where market returns have been sharply higher and significantly lower.

2) The analysis does not include the real world effects of inflation, taxes, fees, and other expenses that subtract from total returns over the long-term.

3) You don’t have 144 years to invest and save.

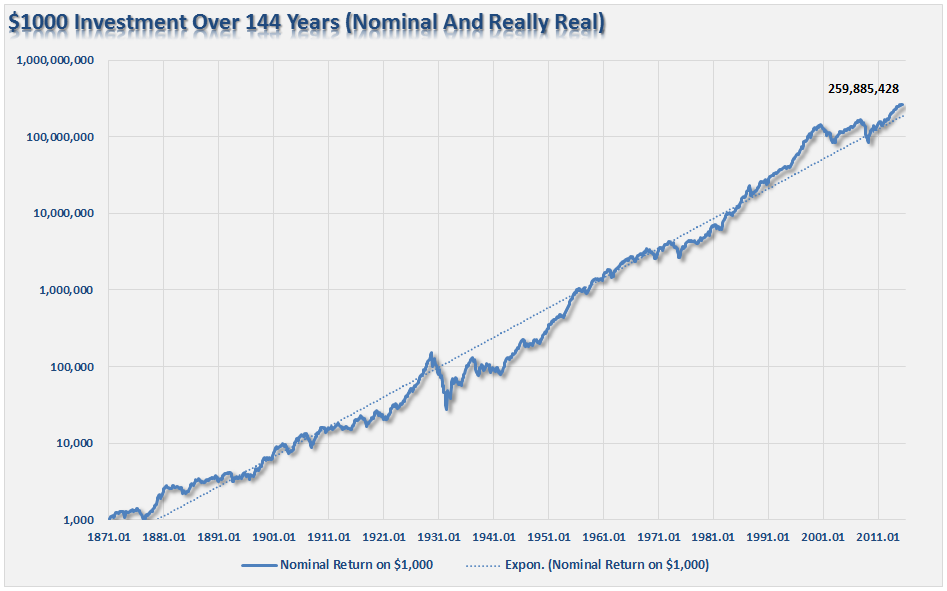

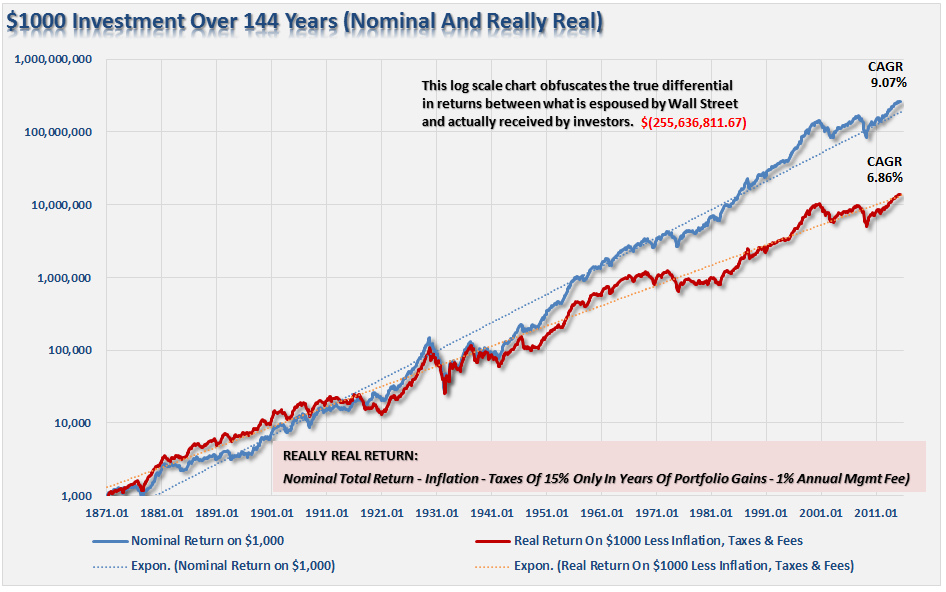

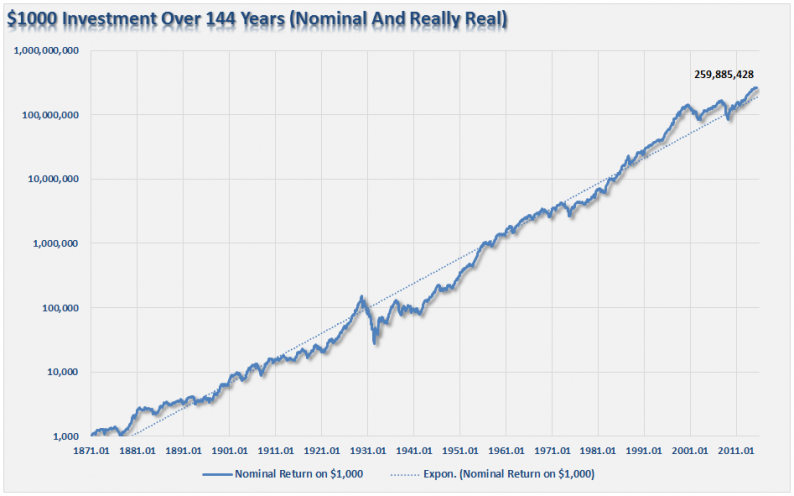

The chart below shows what happens to a $1000 investment from 1871 to present including the effects of inflation, taxes, and fees. (Assumptions: I have used a 15% tax rate on years the portfolio advanced in value, CPI as the benchmark for inflation and a 1% annual expense ratio. In reality, all of these assumptions are quite likely on the low side.)

As you can see, there is a dramatic difference in outcomes over the long-term.

From 1871 to present the total nominal return was 9.07% versus just 6.86% on a “real” basis. While the percentages may not seem like much, over such a long period the ending value of the original $1000 investment was lower by an astounding $260 million dollars.

Importantly, as stated previously, and as I will discuss more in a moment, the return that investors receive from the financial markets is more dependent on the “WHEN” you begin investing.

2) I Can Beat/Outperform The Stock Market

No, you can’t and the data proves it.

Dalbar recently released their 21st annual Quantitative Analysis Of Investor Behavior study which continues to show just how poorly investors perform relative to market benchmarks over time and the reasons for that under performance.

Leave A Comment