A big dividend increase that sends a share price rallying is just what your portfolio needs to remedy this ugly and volatile market.

As a dividend-focused investor, I put less emphasis on short-term share price fluctuations and more emphasis on dividend yields and dividend growth prospects. When the markets get ugly such as what we have experienced in the first month of 2016, it is good to go back to the basics of dividend investing, which for me is dividend growth. A growing payout should, over time, result in a higher share price. One nice way to get a quick start to capital gains from dividend growth is to buy shares just before an announced dividend increase.

I maintain a database of about 130 REITs, which I use to track yields and dividend growth. The typical REIT increases its dividend rate once a year, at about the same time each year. Across the REIT universe, the higher dividend announcements come in almost every month of the year. Each month I like to cover the REITs on my list that have historically increased their payouts in the following month. You can use this information to establish longer-term positions in stocks with growing dividends or try for the short-term capital gain that often occurs when a dividend increase is announced. Here are the potential REIT dividend increases for March.

There are two lodging/hotel REITs that have historically increased dividends in March. They are

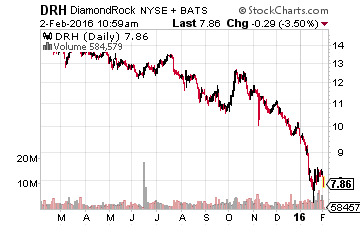

DiamondRock Hospitality Company (NYSE: DRH) and Pebblebrook Hotel Trust (NYSE: PEB). Cash flow in the hotel business is cyclical, and REIT cash flow and dividends have grown significantly over the last three to four years. However, this sector of the REIT space has lost favor with investors and shares are down around 40% in the last year. DRH increased its dividend by 22% last year and the payout is up 56% in the last three years.

Through the first three quarters of 2015, adjusted FFO per share was up 13.6%, pointing to a possible 10% dividend increase this year. DiamondRock usually announces a new dividend rate sometime in March with an end of month record date. PEB increased its dividend by 35% last year, and a total of 258% over the last three years. In the first nine months of 2015, Pebblebrook grew FFO per share by 25%. The company should announce its first quarter dividend in mid-March. With the big sell-off in hotel REIT shares, if these companies do raise their dividends, there could be a big jump in share values.

Leave A Comment