Photo Credit: Arturo Donate

It’s been difficult to find bright spots this earnings season, and with less than 25% of the S&P 500 left to report, it looks like the fourth quarter will close as one of the worst since the recession. Not since the third quarter of 2009 has both top and bottom-line growth for the index come in negative, with current figures standing at -3.5% and -2.9%, respectively.

With that said, there are a handful of names reporting this week that carry a very bullish signal. The following 5 companies have a significant positive delta between the crowdsourced Estimize consensus and the Wall Street consensus, and also have a strong track record of beating analyst estimates. Even so, this quarter has forced us to question a value of a beat in this environment, with forward looking guidance capturing most of the attention of nervous investors.

To have your expectations included in the Estimize consensus for this week’s reports,get your estimates in here!

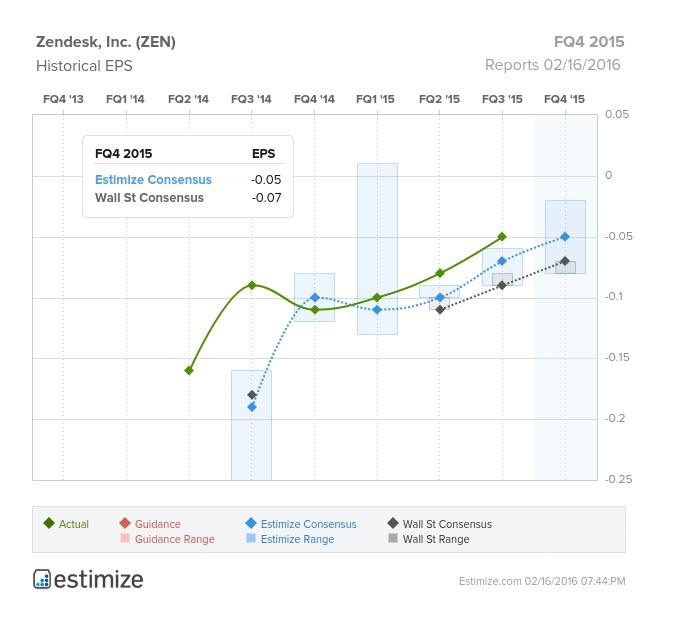

Zendesk (ZEN) was one of our picks for stocks to watch in 2016. Despite the recent unwarranted collapse of enterprise tech names, the US economy by many measures still seems to be in good standing, and that means companies will be investing in the cloud and into their own growth. For the current quarter, the Estimize community is looking for EPS of -$0.05, only two cents higher than Wall Street, but sell-side estimates have been lifting into the report.

Zendesk competes in the customer data management space and is taking on the big guys like Salesforce. Since IPOing in May 2014, the company has had a laser focus on growing revenues, resulting in top-line growth of 63%+ over the last 4 quarters. While still unprofitable, EPS has been trending in the right direction, and the company has beaten Wall Street estimates every quarter.

As of October, ZEN had more than 64,000 customers, up from 50k earlier in the year, and the percentage of clients with 100 or more seats accounted for 30% of recurring revenue. Recent acquisitions such as We Are Cloud certainly strengthen its portfolio and makes it a formidable contender against similar cloud analytics products from Salesforce and Amazon.

Leave A Comment