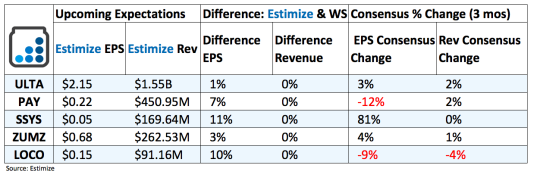

Ulta Beauty (ULTA): Many investors hold Ulta in high regards due to a track recorded extending of topping analyst’s top and bottom line targets. The cosmetics company delivered at least 20% growth in each of the past 8 quarters with double digit gains in key same store sales metrics. When you factor in that similar businesses struggled in recent years, Ulta’s gains look even more remarkable. Robust fundamental support over this time led to a predictable boom in the stock price. Shares boasted a 36% increase in the past 12 months and historically jump about 5% immediately through the print. Investors should still proceed with caution, considering Ulta faces tough comparisons and irrationally high earnings targets.

VeriFone Systems (PAY): Shares of VeriFone tumbled 22% in the past 12 months on the back of weak third and fourth quarters results to cap off fiscal 2016. Management’s comments following the third quarter, in particular, caused analysts to cut forward estimates. To offset additional losses, the company initiated a new restructuring program focused on streamlining operations and designing a long term growth strategy. Apart of that includes adopting Apple, Google and Samsung mobile payment applications into pre existing electronic payments systems. Nonetheless, currency headwinds, depressed consumer spending and ongoing restructuring costs could hamper financial performance for the fiscal first quarter.

Stratasys (SSYS): 3D Systems dismal top line performance in Q4 portends weak results for Stratasys tomorrow morning. Financial performance for SSYS maintains a steady slide down with results in each of the past 5 quarters recording negative growth. In fact, sales for the third quarter missed the Estimize sales target by nearly 10%, but the stock still trades significantly higher compared to a year earlier. Shares jumped 25% in the past 12 months and tend to increase by 1% immediately through the print.

Zumiez (ZUMZ): The company reported a 14.3% increase in net sales with comparable sale gains of nearly 10% for the month of January. In the most recent monthly sales report management also raised fourth quarter sales and earnings guidance to the range of 60 to 66 cents per share. The biggest drivers of this recent success includes a more robust e-commerce platform, efficient customer service, and expanded lifestyle lineup. Despite a rosy financial outlook, the stock continues to struggle with share value down 15% in the past 3 months.

Leave A Comment