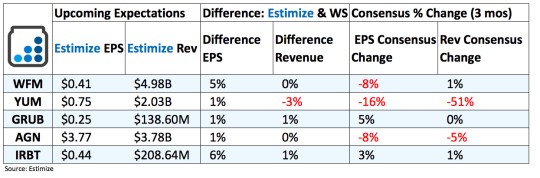

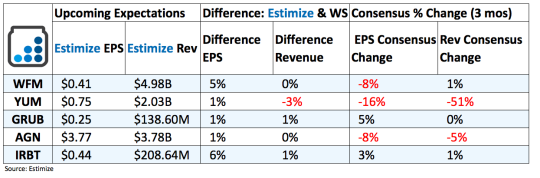

Whole Foods (WFM): Supermarkets faced a slew of headwinds in 2016 including stiff competition, food price deflation and waning store traffic. The combination of these factors made it difficult for high end grocery stores like Whole Foods to re establish its footing. As a result the stock danced sideways for nearly 12 months on a number of mixed earnings reports. Moving forward, the company remains dedicated to revamping its pricing strategy with a focus on value offerings to meet changing spending behavior. The introduction of its lower price point “365? chain promises to help Whole Foods reach said goal. The new stores come equipped with innovative technology, a modern look that appeals to millennials and most importantly lower prices, a concept that once escaped the Whole Foods brand. Many of its initiatives intend to stave off competition from traditional supermarkets like Kroger and non traditional ones like Amazon, Walmart and Costco.

Yum! Brands (YUM): During the fourth quarter Yum Brands completed the spin off of Yum China, creating two independent publicly traded entities. Yum China contributed meaningfully to the top line in previous quarters and for that reason year over year comparisons will look skewed. As for Yum Brands, tomorrow’s report puts the spotlight on KFC, Taco Bell and Pizza Hut to persevere through the changing spending habits. Various digital initiatives such as mobile ordering along with the frequent menu updates, that often include healthier items, aim to boost comps. That said, a number of near term headwinds post a legitimate threat to financial performance, including weak currency translation, volatile consumer spending, and macroeconomic uncertainty.

GrubHub (GRUB): Strong marketing efforts and ongoing initiatives to improve delivery networks helps Grubhub gain traction in areas outside of major cities and also strengthens its competitive advantage. While the company holds an advantage in the space, the business model requires huge volumes to generate meaningful profits. If Grubhub is unable to secure more volume on a sound pricing strategy, this will put pressure on financial performance. Meanwhile, competition continues to emerge from the most likely sources, including threats from Amazon and Uber.

Leave A Comment