(Photo Credit: jshyun)

While the third quarter earnings season unofficially begins on October 8 when Alcoa reports, there are 37 companies from the Estimize universe releasing results for Q3 next week. These are the ones to watch.

Monday, September 21

Tuesday, September 22

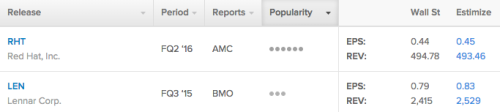

Red Hat (RHT)

Information Technology – Software | Reports September 21, after the close

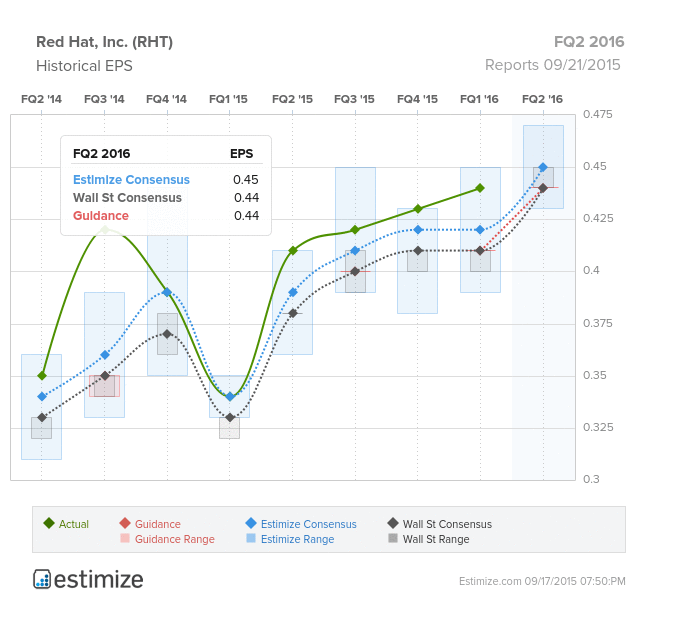

The Estimize consensus calls for EPS of $0.45, a penny higher than both Wall Street and company guidance. In contrast, the Estimize community is expecting revenues of $493.5M, slightly lower than the Street’s prediction of $494.8M and guidance of $494.0M.

What to watch: Red Hat had been a market darling for most of this year, until just last month when it’s stock price fell to the lowest point this year at $68.96. Shares are now trading at $71.14, about flat for the year, and underperforming the NASDAQ which has returned approximately 8% year-to-date (YTD). However, Red Hat’s fundamentals have been strong, with EPS beating expectations in the last 4 quarters. The company has successfully built an attractive pipeline of products and in the process accumulated market share. Its key business units such as cloud computing and its open-source Linux operating software are expected to continue to impress investors. Furthermore, strategic partnerships with household names such as Dell, Intel and IBM have proved to be a win for the company. One note of caution, however, is the RHT’s high valuation. With forward P/E at 70X, any disappointment on the earnings or revenue figures will likely cause the stock to re-rate downwards.

Carnival Corp (CCL)

Consumer Discretionary – Hotels Restaurants & Leisure | Reports September 22, before the open

The Estimize consensus calls for EPS of $1.66, higher than the Wall Street consensus of $1.63 and corporate guidance of $1.58. The Estimize community is also expecting higher revenues of $4.797B as compared to the Street’s estimate for $4.786B, yet lower than guidance of $5.120B.

Leave A Comment