Photo Credit: K?rlis Dambr?ns

Monday, February 22

Tuesday, February 23

Wednesday, February 24

Thursday, February 25

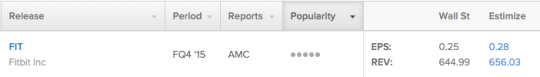

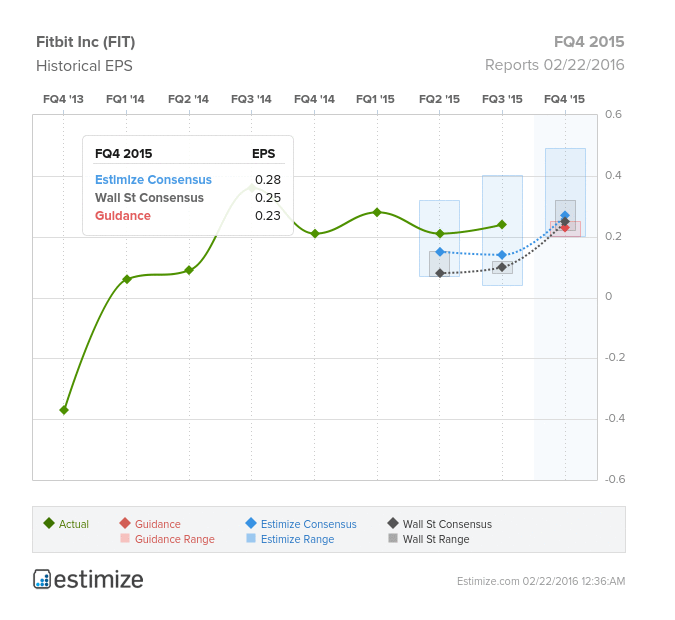

Fitbit (FIT)

Information Technology – Electronic Equipment | Reports February 22, after the close.

The Estimize consensus calls for EPS of $0.28, three cents above Wall Street and a nickel above company guidance. In the wake of a promising Q3 report, fourth quarter estimates climbed to $0.36 from $0.22, but since the beginning of the year, with the stock plummeting and so have estimates, down to their current level. Revenue expectations are also more bullish at $656.24M vs the sell-side’s $644.99M and guidance of $635M. This puts growth expectations at 33% for EPS and 77% for sales. This is a company that has beaten both the Estimize and Wall Street consensus both quarter’s since IPOing in June.

What to Watch: Shares of Fitbit have almost been cut in half since the beginning of the year as competition from other wearables makers, specifically Apple, heats up. The issue for Fitbit is that it is solely a fitness tracker, and falls into the very niche health and wellness sporting goods category. Even when Fitbit does sell one of their devices, active use is not guaranteed. Attrition rates are very high, of the 12M trackers sold, only 6.5M are in active use. Fourth quarter results shouldn’t be hurt however, as holiday sales are are expected to have come in strong, with Fitbit reporting sold out inventory of their Fitbit Charge HR at many stores during the period. First quarter sales haven’t been as strong, however, with many analysts speculating that consumers are waiting for Fitbit’s new Blaze smartwatch scheduled to ship March 1. After tomorrow’s closing bell investor’s will also be looking for updates on standing, specifically the patent suit from competitor Jawbone.

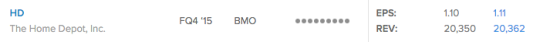

Home Depot (HD)

Consumer Discretionary – Specialty Retail | Reports February 23, before the open.

Leave A Comment