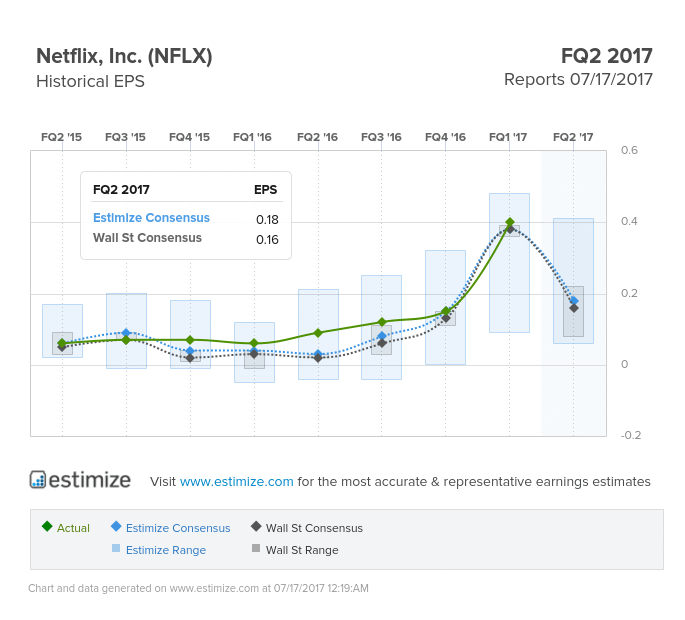

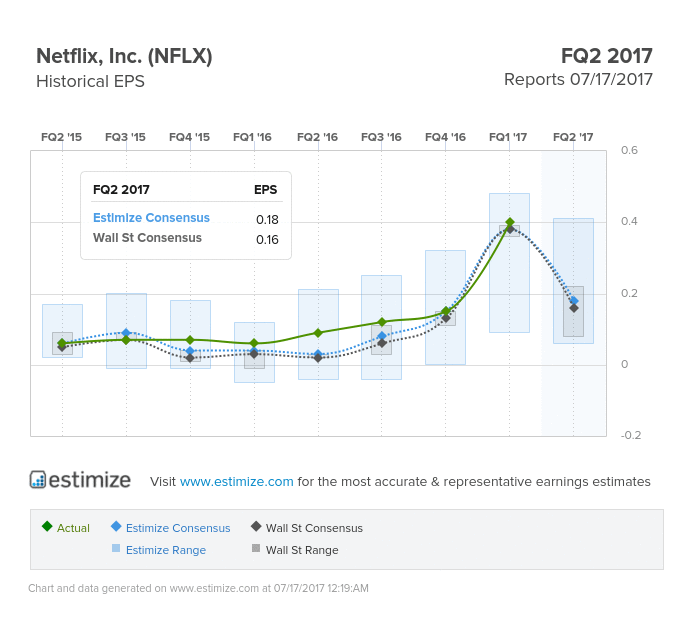

Netflix (NFLX)

Consumer Discretionary – Internet Retail | Reports July 17, after the close.

The Estimize consensus calls for EPS of $0.18, tWO cents higher than the Wall Street consensus, with revenues in-line at $2.76B.

What to watch: Even more so than earnings and revenue actuals, it’s number of subscribers that Netflix investors care about each quarter. For Q2 the Estimize community anticipates total streaming subscribers will hit 103M, a 23% increase from the year-ago quarter. Net subscription additions from the US are expected to total 731,960, and increase of 352% YoY, while international additions are estimated at 2.7M, an 81% increase.

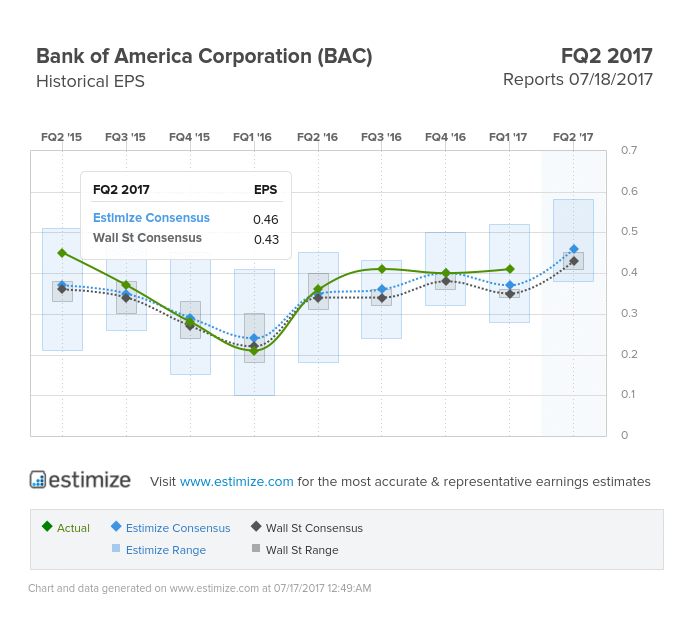

Bank of America (BAC)

Financials – Diversified Financial Services | Reports July 18, before the open.

The Estimize consensus calls for EPS of $0.46, three cents higher than the Wall Street consensus and an increase of 30% YoY. Currently, the Estimize community is looking for sales of $22.25B, also higher than Wall Street’s $21.91B.

What to watch: The big banks (JPM, C, WFC) kicked off earnings season on a high note when they reported on Friday, all beating on the bottom-line, and only Wells Fargo missing on the top-line. However, we have seen a trend of declining FICC trading revenue and equity trading revenue this quarter, slightly offset by increased investment banking revenues. That trend is expected to continue with Bank of America, but to a lesser extent. The Estimize community is looking for a 2% decline in FICC trading revenues YoY, and a 3% decline in equity trading revenues. Investment banking revenues are anticipated to increase 17%.

International Business Machines (IBM)

Information Technology – IT Services | Reports July 18, after the close.

The Estimize consensus calls for EPS of $2.76, three cents higher than the Wall Street consensus. Currently, the Estimize community is looking for revenues of $19.50B, just slightly higher than the Street’s expectation for $19.46B.

Leave A Comment