(Photo Credit: Michael Verhoef)

Monday, November 23

Tuesday, November 24

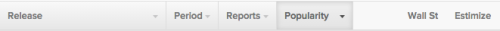

Palo Alto Networks, Inc. (PANW)

Information Technology – Communications Equipment | Reports November 23, after the close.

The Estimize consensus calls for EPS of $0.33, only a penny higher than the Wall Street consensus and company issued guidance, but the dispersion between revenue estimates is wider. Currently, the Estimize community is looking for sales of $287.69, $4M above what the Street is expecting and nearly $6M above company guidance.

What to watch: Even in a crowded cybersecurity space, Palo Alto has been holding it’s own and steadily beating earnings expectations for the last four quarters, and revenue expectations for the last eight. The corporation is known for providing best in class security for private corporations, government and service providers. Despite increased demand for security services over the last year, not all in the space are winners which has allowed PANW to swoop in and steal a bit of market share. The company’s closest competitors are FireEye and Fortinet, both of which disappointed on revenues last quarter. By the end of their 2015 fiscal year, Palo Alto boasted more than 26,000 customers, with new customer acquisition trends remaining healthy into FQ1 2016. Year-over-year billings grew nearly 70% in the latest quarter, continuing a long trend of high double-digit growth in that area, one investors hope can be maintained in the new year. The company also recently announced the launch of it’s latest product, Aperture, an SaaS offering used to increase security for cloud service providers (CSPs) such as Dropbox and Google Drive. This is certainly a space with significant growth opportunities as the number of cloud-based applications have been forecasted to grow 20 – 30% in the next three years.

Tiffany & Co. (TIF)

Consumer Discretionary – Specialty Retail | Reports November 24, before the open.

Leave A Comment