This morning I wanted to find 5 Small Cap stocks that had consistent price appreciation so I used Barchart to sort the S&P 600 Small Cap Index stocks first for the highest Weighted Alpha, then I used the Flipchart feature to find the stocks trading above their moving averages. Today’s Watch List includes: Lending Tree, Nektar Therapeutics, Solaredge Technologies, LGI Homes and Rogers.

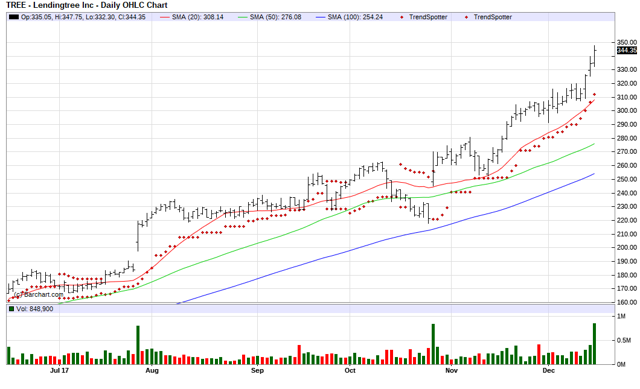

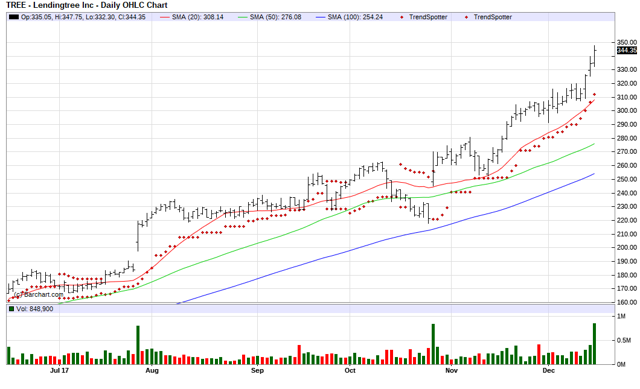

Lending Tree (TREE)

Barchart technical indicators:

247.60+ Weighted Alpha

100% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

13 new highs and up 26.74% in the last month

Relative Strength Index 80.49%

Technical support level at 335.18

Recently traded at 344.35 with a 50 day moving average of 276.08

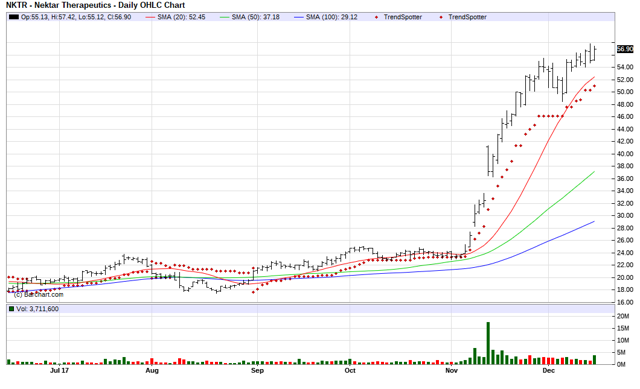

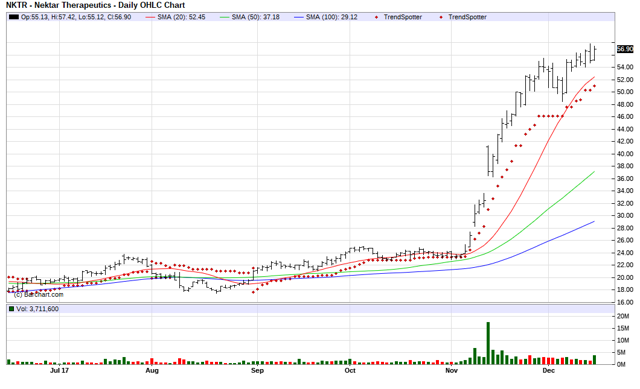

Nektar Therapeutics (NKTR)

Barchart Technical indicators:

225.70+ Weighted Alpha

88% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

10 new highs and up 32.11% in the last month

Relative Strength Index 72.30%

Technical support level at 55.54

Recently traded at 56.90 with a 50 day moving average of 37.18

Solaredge Technologies (SEDG)

Barchart Technical indicators:

189.40+ Weighted Alpha

56% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

4 new highs and up 2.01% in the last month

Relative Strength Index 64.01%

Technical support level at 37.6

Recently traded at 38.15 with a 50 day moving average of 34.44

LGI Homes (LGIH)

Barchart technical indicators:

179.10+ Weighted Alpha

96% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

12 new highs and up 14.61% in the last month

Relative Strength Index 67.85%

Technical support level at 71.01

Recently traded at 72.58 with a 50 day moving average of 62.61

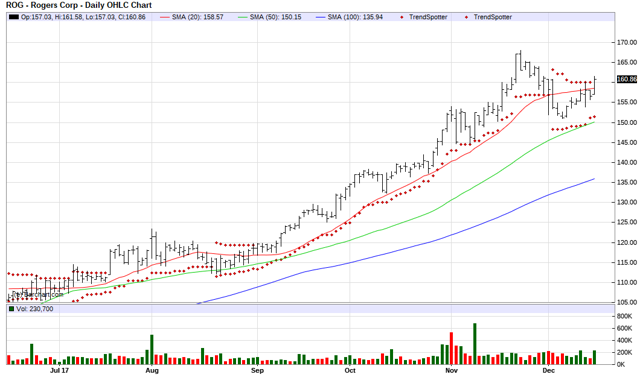

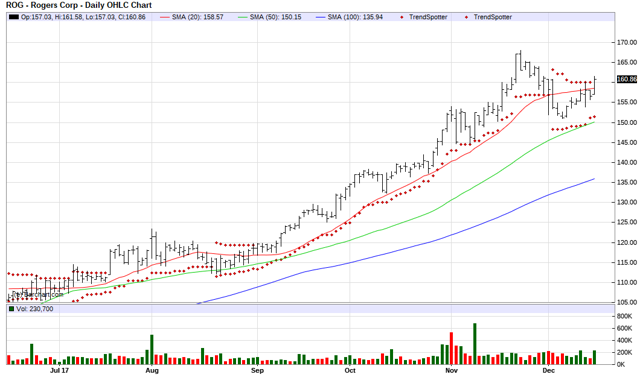

Rogers (ROG)

Barchart technical indicators:

Leave A Comment