Just as quickly as the second quarter ended, we are now starting to get a trickle of early Q3 reports. Next week, four popular names will release results, as well as the August reading on retail sales.

Tuesday, Sept 15

Wednesday, September 16

Thursday, September 17

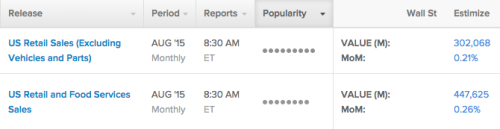

Retail Sales

Reports September 15, before the open

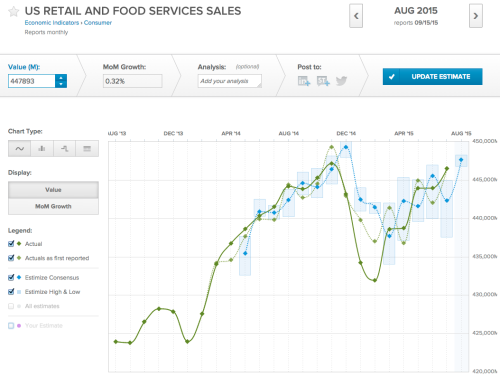

The Estimize community is looking for US Retail and Food Services Sales to hit $447,911 for the month of August, a MoM increase of 0.32%. Excluding vehicles and parts, that estimate drops to $302,169, only a 0.24% increase over July.

What to watch: Retail sales have been mixed so far this year. Despite lower gas prices which were expected to give a boost to retailers, consumers have changed the way they spend, allocating discretionary income towards technology and health care, not traditional apparel and accessory retailers. In fact, the retail sales figure does not accurately represent the consumption economy anymore. Digital goods are not reflected, which is a big chunk of consumer purchases. For instance, 1% of the world’s population purchased an iPhone 6 in the first quarter, and that is not accounted for in retail sales. We have seen a pickup in purchases of large ticket items such as autos, which had been slumping a couple of years ago. Continually low interest rates have encouraged auto sales, with 17.8 million vehicles sold in August, up 1.5% MoM led by SUVs and Pickup trucks as lower fuel prices have caused consumers to feel more comfortable purchasing gas guzzlers.

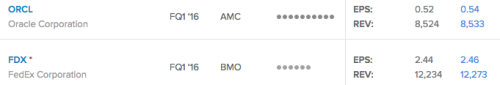

Oracle Corporation (ORCL)

Information Technology – Software | Reports September 16, after the close

The Estimize consensus calls for EPS of $0.54, two pennies higher than the Wall Street consensus. The Estimize community is also expecting slightly higher revenues of $8.54B as compared to the Street’s estimate for $8.52B.

What to watch for: Estimates suggest Oracle’s Q3 earnings will be down 13% YoY, with revenues falling nearly 1%. It’s no secret that the strengthening exchange rate in the US has been an issue for the tech giant, responsible for revenues that dropped 5% YoY in Q2; on a constant currency basis the top-line would have increased 3%. Oracle is also trying to enter the cloud space, but is playing catchup as several competitors are well ahead. Investors will be looking for an improvement in this segment on Wednesday, with cloud progress disappointing last quarter when sales only increased a meager 2%. However, Cloud software as a service (SaaS) and platform as a service (PaaS), as well as infrastructure as a service (IaaS) did markedly better, increasing revenues by 29% and 25%, respectively. The segment lagging the most at this point is Oracle’s legacy hardware business, showing declining revenues for several quarters now.

Leave A Comment