I maintain a database of about 140 REITs to track yields and dividend growth rates. I take this information and then search out those REITs that have histories of paying dividends and have increased their FFO enough to support a dividend increase. Out of the 140 I track, these six have the best chances of seeing dividend increases in the coming month.

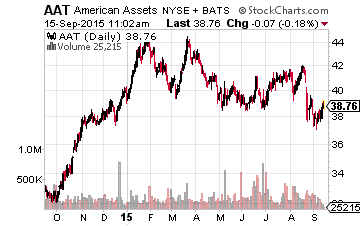

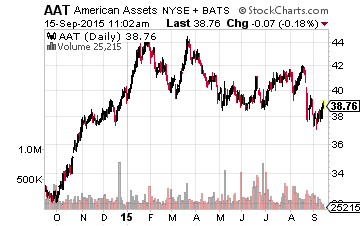

American Assets Trust, Inc (NYSE:AAT) has a $1.7 billion market cap and the company owns a mixed portfolio of retail, office, and multi-family properties. Company headquarters are in San Diego. The portfolio focuses on high-barrier-to-entry markets in Southern California, Northern California, Oregon, Washington, and Hawaii. AAT launched with a January 2011 IPO. The dividend has been increased by about 5% each of the last two years with the announcement coming at the end of October or in the first few days of November. Second quarter FFO per share was up 13% compared to a year earlier. The current dividend rate is 53% of management’s 2015 FFO guidance. AAT yields 2.4%.

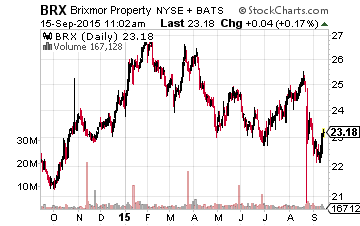

Brixmor Property Group Inc (NYSE:BRX) is a $6.9 billion market cap company that owns grocery store anchored community and neighborhood shopping centers. BRX came to market with an October 2013 IPO. After one year, the company increased its dividend rate by 12.5%. The new dividend rate was announced at the end of October last year for a January dividend payment. BRX currently yields 3.9% with a 47% payout ratio of the FFO for the last four quarters.

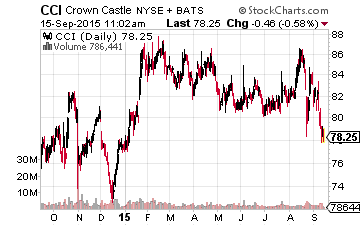

Crown Castle International Corp (NYSE:CCI) owns and leases out cell phone towers. The company has a current market cap of $26 billion. The company converted to REIT status effective January 1, 2014. In late October last year, a new dividend rate was announced with a 134% increase over the previous dividend amount. The October announcement is for the dividend paid at the end of December. The current dividend rate is 77% of 2015 AFFO guidance, which is forecast to be 6% higher than the AFFO per share generated in 2014. A dividend increase of 5% to 6% seems to be in the cards. CCI currently yields 4.2%.

Leave A Comment