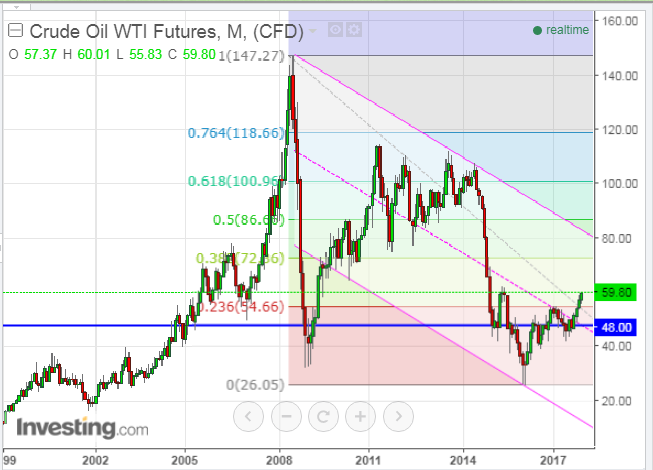

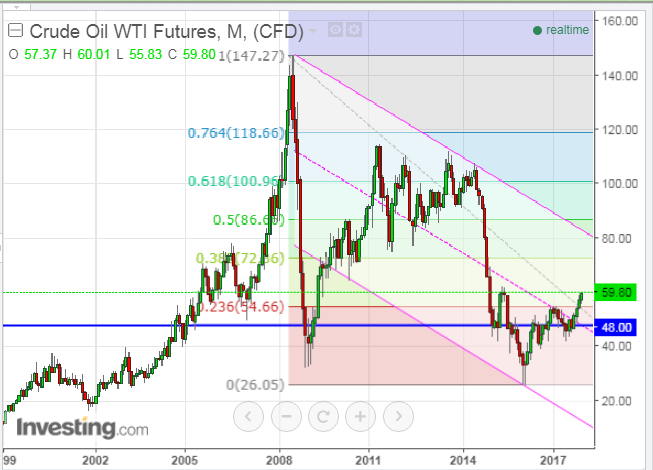

As noted on the following Monthly chart, 72.00 (40% Fibonacci retracement level) could be the next major target for WTI Crude Oil.

Price briefly hit the 60.00 level yesterday (Tuesday) and was trading above two levels of major support — 54.66(23.6% Fib retracement level) and 48.00 (price and channel centreline support).

As long as price can re-take 60.00 and hold above that level, there’s a good chance we may see it climb to its next major resistance level of 72.00.

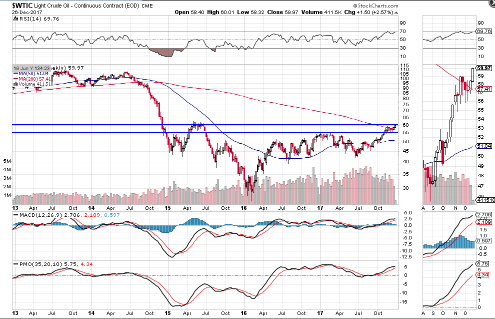

On a shorter (weekly) timeframe, price will, first, need to hold above 57.41 (200-week moving average) and 55.00 (price support), inasmuch as there is very high volatility below.

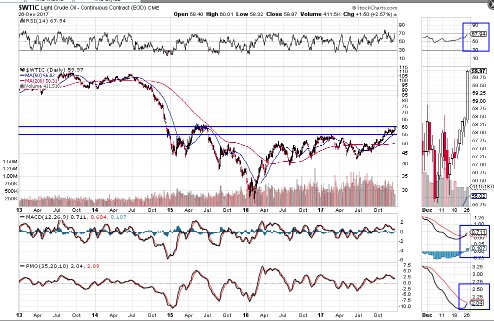

In addition, on a Daily timeframe, watch for a bullish crossover to form on the PMO indicator, the recent crossover to hold on the MACD, the RSI to hold above 50.00, and price to remain above the 50-day moving average at 56.02.

Leave A Comment