This week is going to be centered around the Fed’s decision on interest rates on Wednesday. This rate hike will be met with much less angst than the previous two as investors become accustomed to the Fed raising rates at a faster clip than 25 basis points per year. The decision on rates will be the least important part of the announcement because the market is so certain it will raise rates. The CME Group Fedwatch tool has the Fed at a 95.2% chance of raising rates.

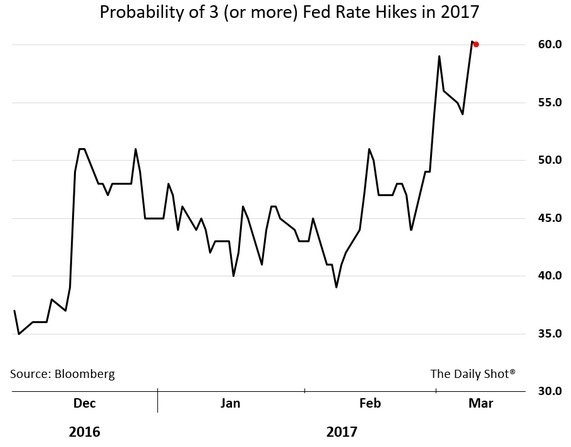

The key will be the Fed’s guidance; this will either be a hawkish hike or dovish hike. This hike will different from the first two as it will likely be more hawkish considering the Fed has two more hikes left to go this year. As you can see in the chart below, there’s about a 60% chance there will be three rate hikes in 2017. In talking up the odds for a March rate hike, it’s implied that it will continue down the path of its original guidance. If the Fed talks about its balance sheet, it will be the biggest news of the statement. In my opinion, the Fed will either discuss unwinding the balance sheet or not discuss it at all. Not discussing it would be a dovish signal. Goldman Sachs expects the unwind to start in Q4 which means discussion must begin soon to explain to the market the specifics of how it will get done.

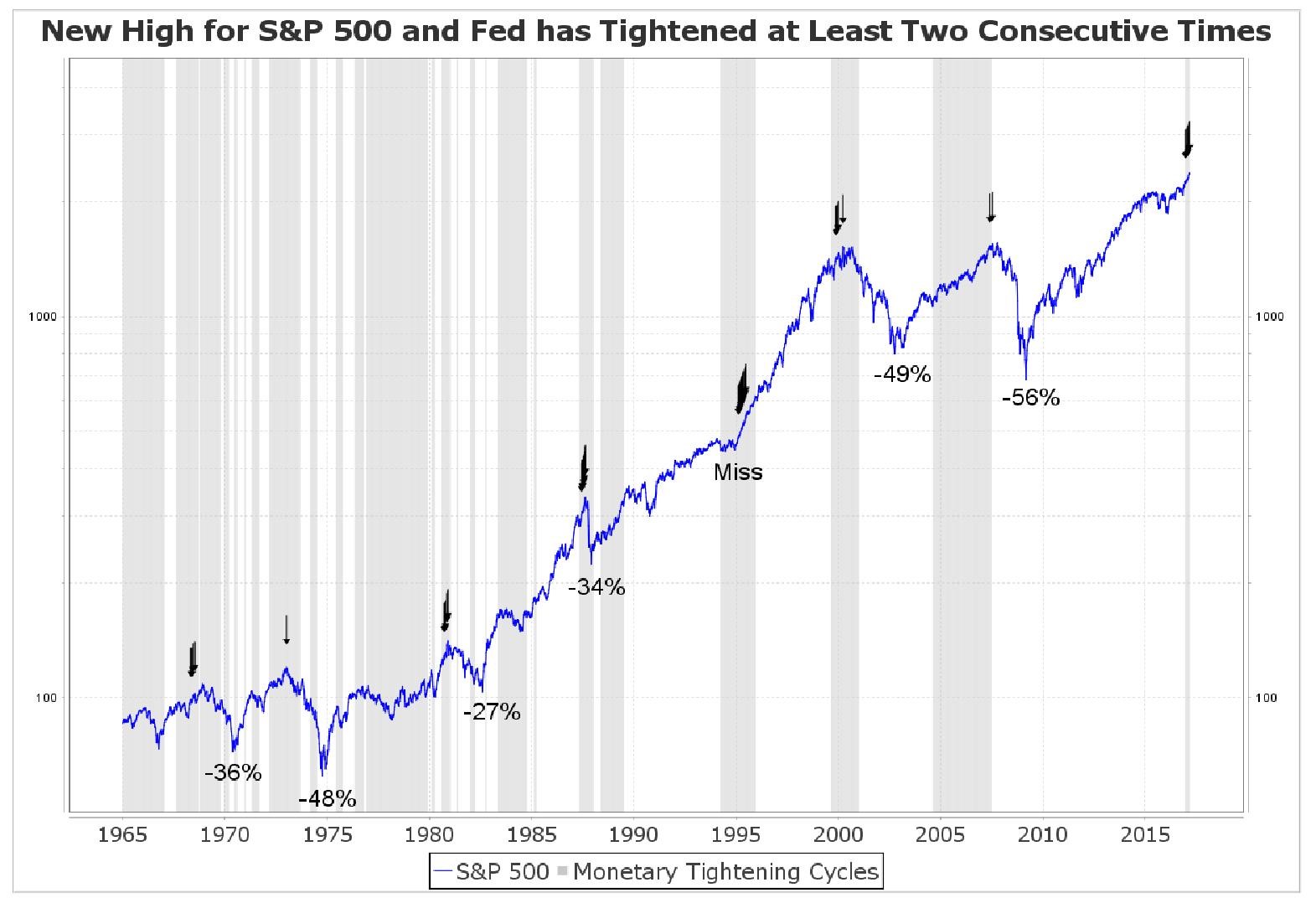

A tightening Fed is a bearish signal for stocks after the first two rate hikes. Because it started out slow, I think the negative signal is slightly delayed. However, given the accelerated pace for 2017, I think the negative signal is now in place. As you can see in the chart below, the sell signal, which is triggered when the Fed tightens two consecutive times and the S&P 500 is at new highs, has been correct six out of seven times. The accommodative cycle we just exited was the longest ever. I contest this means the bubble is the biggest, but that remains to be seen.

FactSet released it’s the latest aggregate earnings data Friday afternoon. The reports aren’t as data-laden as they had been in the past few weeks because earnings season is over. The only information we have is changes to earnings expectations for Q1 and the full year 2017. The latest estimates are positive because there wasn’t much change in the bottom-up estimates. As the saying goes ‘a bird in the hand is worth two in the bush.’ The estimates previously seen are now more likely to occur as we get closer to the reporting period.

Leave A Comment