If the US or the Eurozone entered a recession this year, a few macroeconomic variables would look very different relative to previous recessions.

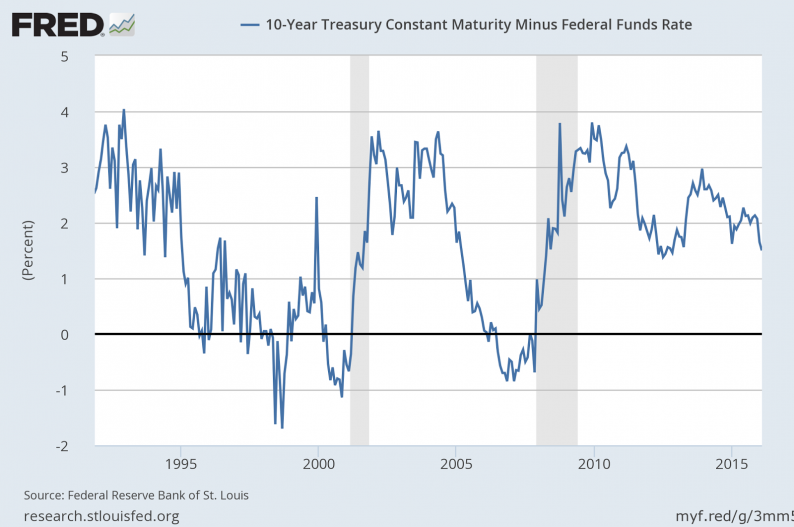

1. The Yield curve would be very steep. Unlike in any previous recession when the yield curve was flat or inverted.

2. The real federal funds rate (or the ECB real repo rate) would be extremely low and would be at a level similar to that of the beginning of the expansion. Unlike in previous recessions where the real central bank interest rates was high relative to the beginning of the expansion.

3. And nominal central bank interest rates would be stuck at zero so there will be no room to lower them in response to the recession. Unlike in previous recessions where nominal interest rates came down by about 4-7 percentage point (this is also true for real interest rates, see previous chart).

So maybe this tells us that a recession is not about to happen. But if it is, the lack of space to implement traditional monetary policy tools should be a big concern for policy makers. If a recession ends up happening, helicopter money will likely become a policy option.

Leave A Comment