A May 16 article outlined the concepts shown below in detail; big moves often come in the stock market after long periods of consolidation.

Normal Retracement Or New Trend?

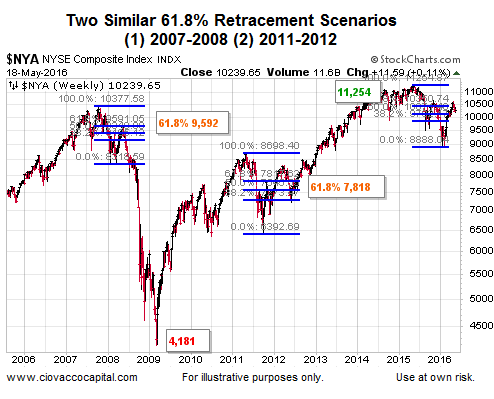

Is there anything else historically that says a big move may be coming in equities? Yes, the concept of Fibonacci retracements (see chart below). It is normal and to be expected that in the context of an established downtrend to see countertrend moves back to one of the three major Fibonacci retracements (Fibs). So far, in 2016 the sharp rally off the February lows has not exceeded “normal retracement” territory. In this case, retracement refers to the retracement of the down move from point A to point B.

Fibs Help With Bullish and Bearish Odds

Do markets always reverse near the major Fibs? No, Fibs simply help us with probabilities. The weekly chart of the NYSE Composite (2006-2016) below shows a bearish case and a bullish case.

The point of the exercise is that big moves can result once the market decides which way it wants to go near the 61.8% retracement of a large market decline. The bearish move from the 61.8% level in 2008 to the 2009 stock market low was a drop of 56% (a big move). The bullish move between the 61.8% level in 2011-2012 was a gain of 44% (a big move).

How Much Value Can Be Added Or Lost?

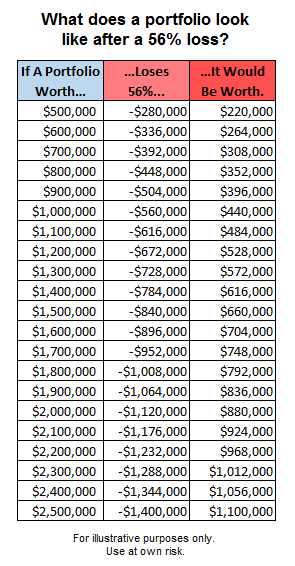

The table below puts a 56% drop in perspective based on numerous portfolio sizes.

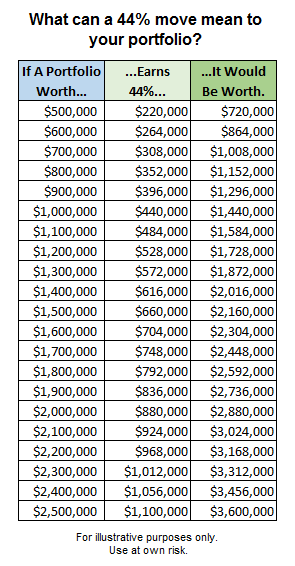

Conversely, a 44% gain can make a significant contribution to an individual’s nest egg.

Big Move Can Be Up Or Down

The market was on the ropes in early February and righted itself after central banks started throwing spaghetti at the monetary policy wall.

Which way is the market leaning now? As noted in a May 13 video Noticeable Cracks In Bullish Foundation, the market’s current bias is starting to shift back to the concerning side of the bull/bear ledger. However, global central banks are still throwing numerous forms of market-friendly spaghetti to see if anything sticks, as outlined on May 11. Under our approach, we will allocate based on the facts in hand, while remaining open to a big move up (similar to 2012-2015) or a big move down (similar to 2008-2009). The hard data will guide us if we are willing to monitor the markets with a flexible, unbiased, and open mind.

Leave A Comment