All around the world, millions of people are working jobs far from their homes. They spend little and send most of their cash back home.

This transnational river of money is known as the remittance market. And it’s very, very large.

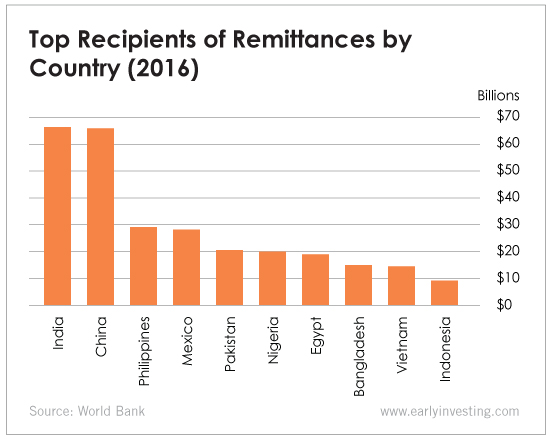

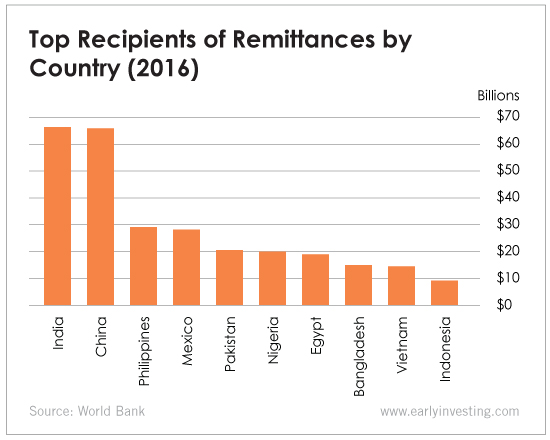

Here are some of the top countries for inbound remittance in 2016 (estimated):

The whole market is estimated to be worth around $500 billion per year. The dollar amounts range from small chunks to thousands of dollars.

Currently, this market is dominated by firms like Western Union, MoneyGram and a few other large players.

Each of these transfer companies must have cash agents all over the world. Local retail stores, for example, hand out cash to recipients in exchange for a cut of fees.

A majority of this cash is transferred through the U.S.-controlled SWIFT banking system today.

Fees are high, especially for small transfers. For example, to send $20 from the U.S. to the Philippines costs $5, plus around 6% in currency exchange loss.

Fees vary widely and are generally cheaper with bank-to-bank transfers. However, many people in developing countries don’t have bank accounts, so they wind up paying extreme amounts to send cash back home.

Remittance: A Perfect Fit for Blockchain/Bitcoin Technology

By now you’ve probably heard about bitcoin. But if you’ve never understood what a real life application of this new tech might look like, now is the perfect time.

With bitcoin and other “cryptocurrencies,” international borders aren’t much of a barrier at all.

It’s simple, quick and cheap to transfer money with bitcoin. Millions of dollars can be “wired” for almost nothing. And legal frameworks are being developed around the world to handle these types of transactions.

As you can probably guess, bitcoin’s decentralized and digital nature makes it a natural fit for the remittance market.

Leave A Comment